Kevin O’Leary Who Does Budding Startups from Shark Tank to COVID-19 Crisis

Terence Thomas Kevin O’Leary is a Canadian entrepreneur, author, politician, and television personality. O’Leary co-founded SoftKey Software Products, a technology company that sold software geared toward family education and entertainment. During the late 1980s and 1990s, SoftKey acquired rival companies such as Compton’s New Media, The Learning Company, and Broderbund. SoftKey later changed its name to The Learning Company and was acquired by Mattel in 1999, with the sale making O’Leary a multimillionaire.

From 2006, O’Leary appeared as one of the five venture capitalists on the then-new show Dragons’ Den on CBC, the Canadian instalment of the international Dragons’ Den format. On the show, O’Leary developed a persona as a blunt, abrasive investor, who at one point told a contestant who started crying, “Money doesn’t care. Your tears don’t add any value.” This television persona was encouraged by executive producer Stuart Coxe, who during the first two seasons occasionally asked O’Leary to be “eviler”. Dragons’ Den became one of the most watched shows in CBC history, with around two million viewers per episode. Coxe attributed the show’s success in large part to O’Leary’s presence.

In 2009, the American version of Dragons’ Den, Shark Tank, began, and Shark Tank executive producer Mark Burnett invited two of the CBC Dragons’ Den investors, O’Leary and Robert Herjavec, to appear on the show. Both have remained with Shark Tank since the beginning. For several years, they appeared on both shows, although Herjavec left Dragons’ Den in 2012, and O’Leary left in 2014. Shark Tank became a rating hit, averaging 9 million viewers per episode at its peak in the 2014-15 season. It has also been a critical favorite, winning the Primetime Emmy Award for Outstanding Structured Reality Program three times.

O’Leary’s appearances on Dragons’ Den and Shark Tank popularized the nickname “Mr. Wonderful” for him; he has said that he is often referred to by that name in public. O’Leary has said that the nickname serves both as a tongue-in-cheek reference to his reputation for being mean, as well as a reflection of his view that his blunt assessments are helpful to misguided entrepreneurs. In a 2013 interview, O’Leary implied that he could not remember how he got the nickname. He had already referred to himself as “Mr. Wonderful” in a 2006 casting video for Dragon’s Den, predating either show.

Besides his blunt persona, O’Leary also gained a reputation on both shows for preferring deals in which he loans the entrepreneurs money in exchange for a percentage of future revenue, rather than taking a share of the company.

Notable deals in which O’Leary has been involved on Shark Tank include investments in Talbott Teas (later bought by Jamba Juice) and GrooveBook (later bought by Shutterfly), the latter with Mark Cuban. O’Leary has a holding company, called “Something Wonderful”, for managing his Dragons’ Den and Shark Tank investments.

The Story Behind the Moniker Mr. Wonderful’s Kevin O’Leary

It looks like fellow shark Barbara Corcoran is the one who started the nickname. O’Leary told Boston Magazine how it all started. “In season one, someone was trying to sell a publishing deal to us for music and I proposed an aggressive 51 percent equity position because I wanted control of the business,” O’Leary commented. Suddenly, Barbara said, “Well aren’t you Mr. Wonderful?”.

The moniker took on a life of its own, and O’Leary uses it to his advantage. “Now it is at a whole new level. I show up at hotels and my reservation is under the name Mr. Wonderful,” O’Leary shared. “They don’t even know my real name. That’s just nuts.”

Furthermore, Barbara Corcoran has also called O’Leary’s treatment of one entrepreneur “too mean.”

The pitch was for Wisp, a re-engineered broom and dustpan that supposedly makes cleaning easier by featuring dense bristles for a squeegee-like seal. The founder, Eben Dobson, walked into the Tank asking for $500,000 in exchange for a 10 percent stake in his business. However, O’Leary offered up a deal, though not quite what Dobson was looking for: $500,000 for a 50 percent stake.

Lori Greiner, who is the host of her own popular show on QVC, offered to do the selling if O’Leary put up the money. “That’s something we can deal with later,” O’Leary told Greiner.

Dobson asked O’Leary why he did not want to include Greiner in the offer.

“I might, but she is not putting up any money right now, so I’m not worried about it…” O’Leary said. “Evan, if you want to do a deal with Lori, do a deal with Lori, she has no money for this deal. What do you want to do?”

Dobson accepted O’Leary’s offer. O’Leary eagerly got up to shake his hand, but Dobson kept talking: “But don’t lose her number,” Dobson said, referring to Greiner. O’Leary sat back down. “She has no money,” O’Leary said. “I know her number, I can call her anytime I want or if I need her.”

Dobson kept pushing for Greiner, asking if she had anything to add. The move pushed O’Leary over the edge. “That’s its Evan, I’m out,” O’Leary said, rescinding his offer. “Get out of there. I am gone. I am an investor. I had the 500 thousand dollars. It was in your hand, and you are talking to her? You’re out of here.”

Corcoran watched from her seat grimly and put her head in her hands, exasperated, as Dobson dejectedly left the Tank. “That was too tough, I’m sorry,” Corcoran told O’Leary.

“Are you out of your mind?” O’Leary responded. “That was too tough for that man…” Corcoran said again. “Too mean.” “Oh, I’m too mean?” O’Leary said, as the sharks shouted over each other.

“Oh golly, I feel terrible,” he said sarcastically.

Worth approximately $400 million as reported by Investopedia, O’Leary has invested in some of the most profitable deals on Shark Tank. One of his deals almost never happened. According to CNBC, Mark Cuban struck a deal with the company Plated in Season 5 in 2014, but negotiations fell through. O’Leary followed up with the company in an episode of their spinoff show Beyond the Tank, and he ended up investing in the meal delivery service. The company was sold in 2017 to Albertson’s grocery chain for $300 million dollars, making O’Leary a 1,346 percent return on his investment.

In Season 5, O’Leary also saw a winner in Groovebook, a photo-printing app subscription service. The company was sold to Shutterfly in November 2014 for $14.5 million, making another big payout for O’Leary.

According to Britannica.com, O’Leary’s place in TV started on the Canadian Broadcasting Corporation (CBC) as a panelist on the reality show Dragon’s Den in 2006, which would later be produced in the U.S. in 2009 as Shark Tank. O’Leary appeared on both programs until 2014, when he left the Canadian-based program to swim with the sharks exclusively.

O’Leary commented to the Financial Post back in 2013 on the difference between the two programs. “One is not better than the other – the platform is different. In the U.S. the producers spend a tremendous amount of time digging into the backgrounds of the people presenting, so as a shark I get a pre-pack of where they came from, history, what school they went to. I know more about them as individuals,” O’Leary said.

Fellow shark and former Dragon’s Den panelist Robert Herjavec, also a native Canadian, left for Shark Tank before O’Leary, telling The Hamilton Spectator “The platform here is much bigger,” he said of the U.S. market. “The audiences are much bigger.”

Surprisingly, it is in a Dragon’s Den episode from 2009 that he has heard uttering the “Mr. Wonderful” moniker for himself. Maybe it will never be determined how the now infamous nickname originated.

The Truth Embedded in Harsh Advices to Startups from Kevin O’Leary

While the nickname Mr. Wonderful may sound like sarcastic jab at Kevin O’Leary’s personality, the moniker could not be more accurate. The Shark Tank judge doles out harsh advice to hopeful entrepreneurs, but he does it with good intentions.

O’Leary’s demeaning comments to entrepreneurs provide some of the most entertaining moments on the show, and he is fully embraced the role of the mean, sarcastic guy, a staple of many competitive reality shows. However, O’Leary said that he stopped noticing the cameras years ago. He said he strategically added venom to some of his critiques. “I’m trying to test the mettle of those entrepreneurs, because if they think it is tough in the “Shark Tank,” wait until they get out in the real world. If they cannot take a guy like me, then they’re not ready.” O’Leary said.

He articulated that he looked at business as binary: Either you make money, or you lose money.

Fellow Shark Barbara Corcoran is by no means a pushover when it comes to investing, but she usually prefers to cushion her critiques, unless she feels wronged by entrepreneurs or unless they ae “rich kids”. O’Leary, on the other hand, says being polite gives false hope to failing entrepreneurs, which could be meaner than compelling them to give up or shape up.

“I say to Barbara all the time, ‘Why are you so worried about their feelings? Who cares? If the business has no merit and it is a bankrupt idea, they are going to fail anyways. You are doing them a huge favor if you are telling them the truth,'” O’Leary says.

And if he insults an entrepreneur and is objectively wrong about his assessment, he explains, he wants them to debate him and tell him why he is wrong.

He also says there is a difference between times he is aggressive and when he is genuinely angry. He saves his anger for the “Shark Tank” business owners who are arrogant yet ignorant about major flaws in their companies or products.

“It frustrates me miserably because they’ve just wasted my time and they wasted the opportunity in the “Shark Tank” that somebody else would’ve begged to have had,” O’Leary says. “I’m extremely harsh on people like that. And for good reason in my view.”

Any time O’Leary calls an entrepreneur a “cockroach” or says their product “sucks,” he is making great television. But he is also just acting on his business philosophy, he says.

“I’m not trying to make friends. I am trying to make money. It’s that simple.”

That straightforward response and attitude stems from a personal golden rule O’Leary is fiercely proud of: Honesty. He believes that honesty is the key factor to his success – even if his sometimes-harsh opinion leads to some tears and broken dreams for budding entrepreneurs. O’Leary says “entrepreneurs have to learn that not everything works, and I am there to tell them the truth. That is why I they call me Mr. Wonderful.”

“When in reality, sometimes they do not. Deal with it. Get over it, pick yourself up off the floor, and start again. That is what entrepreneurship is all about.” O’Leary said.

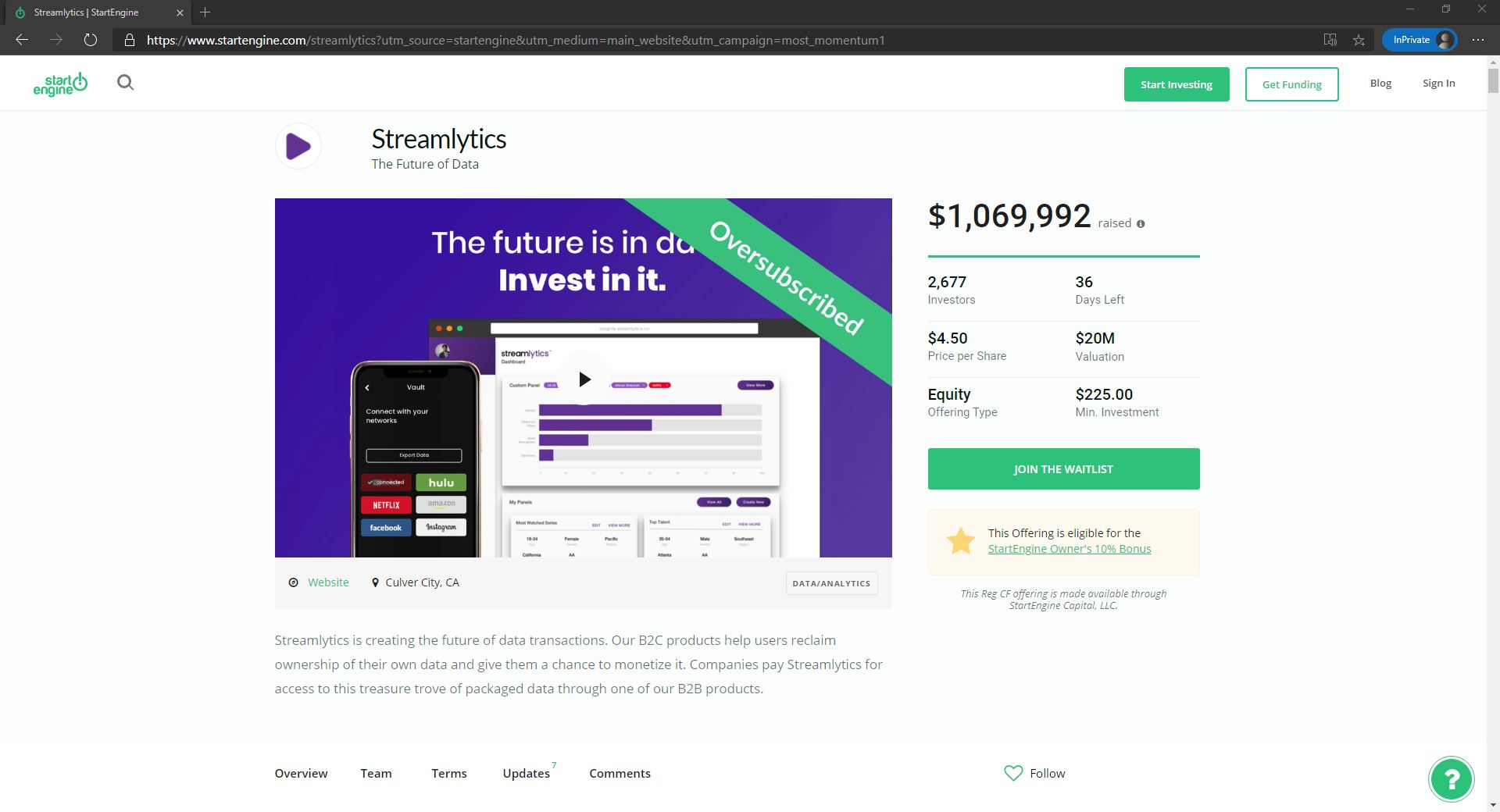

Kevin O’Leary Partners with Crowdfunding Platform and Offers Advice to Entrepreneurs

According to NBC News, a record-breaking of nearly 50 million people have filed for unemployment benefits in July due to the COVID-19 shutdown of industries nationwide. With company owners struggling to survive, they are trying to leave no stone unturned in creating ways to save their businesses without cutting employees. O’Leary is offering an option to entrepreneurs through his alliance with the crowdfunding platform StartEngine.

“I am partnering with StartEngine and am now a Strategic Advisor, a shareholder, and a paid spokesperson for the company,” O’Leary announced. “This is a tough time for everyone, particularly so for entrepreneurs who need access to funding, and through this partnership, I am helping to spread awareness about an alternative way, maybe one of the few ways today, for entrepreneurs to raise capital.”

With the platform assisting over 325 businesses raise funding and over 235,000 investors in their network, the Shark Tank star found StartEngine to be the platform he could back with full confidence.

“I think equity crowdfunding has a lot of merit, but until I came across StartEngine, there wasn’t a platform that had critical mass and was approaching that inflection point of hyper growth,” Mr. Wonderful told.

O’Leary has his own packed portfolio of companies he has invested in through Shark Tank and other opportunities and is advising his entrepreneurs to consider StartEngine in acquiring the capital they need during this time.

Equity crowdfunding has unique advantages, such as creating brand ambassadors out of your shareholders and letting the entrepreneur set the terms of the raise and stay in control of their business. “I am telling them to explore StartEngine as a viable option for their funding needs,” he shared.

Equity crowdfunding, rather, has stood up during difficult times. The model got a lift during the credit crisis, after the passage of the Jumpstart Our Business Startups (JOBS) Act in 2012. The law loosened SEC regulations on small businesses to make it easier for them to fundraise, such as by allowing greater access to crowdfunding. Previously, equity stakes in non-public companies were only available to accredited investors–those who earn more than $200,000 a year or hold more than $1 million in assets.

The financing mechanism that allows individuals and groups of investors to fund startups in exchange for equity should be in your toolkit, suggests O’Leary. “This is probably the most viable opportunity there is for raising capital given an environment that is in shock right now,” adds O’Leary, who notes that venture funding has largely dried up.

#1: The funding vehicle can help serve as a lifeline for struggling

With the economy spiraling, O’Leary tells business owners to get creative on funding and overall management to avoid layoffs.

“My advice is simple: Weathering a crisis comes down to a single factor. How much cash do you have? I’ve told the companies in my portfolio to reduce burn where they can, but not so much that they can’t bounce back quickly when the market turns,” O’Leary shared. This means that entrepreneurs should avoid cutting employees if they can and instead focus on improving operational efficiencies. They can also take SBA loans, which in certain cases will be forgiven. However, VC-backed companies cannot access those great loans.

According to the Washington Post, the $2 trillion federal coronavirus relief package signed last week includes a nearly $350 billion for small businesses to receive stimulus loans and grants through what is now called the Paycheck Protection Program. While this is a productive move, O’Leary recommends that government leaders consider further options.

“I think the stimulus package is a step in the right direction, but many small businesses will be unable to survive the coming weeks, at which point the Small Business Loans in that stimulus package won’t help,” the Shark Tank investor explained. In the meantime, he has recommended providing all the aid to small businesses who employ over half the country. He also thought that the SEC should accelerate the JOBS Act improvements and help businesses raise capital from the public.

#2: Adapt when business models flip

Entrepreneurial companies have an ability to pivot in a way large company cannot. Primarily, a large company does not have the same stress about its survival that a small company has. A start-up has to make its numbers, whatever it takes, and that leads to innovation that is the hallmark of entrepreneurs. “I find large-cap companies fight this kind of innovation. I have done lots of joint ventures with large companies only to be disappointed that you cannot get anything done at a table with 25 executives.” O’Leary said. They lost their DNA to pivot. But they have to learn to do it fast now because they have no choice.

This crisis has forced companies to rethink so many things. “I would never have implemented remote work at my companies. I would not trust the technology. I would not trust the time shifts. But I am forced to do it now and I am seeing all kinds of opportunities to cut costs, primarily at the expense of landlords.” O’Leary said. “I think American business will come out of this with enhanced efficiency and learn to use technology in ways we would have never done before.”

#3: Become agile and prepare for new normal

Large companies have been using two-tier distribution, in some cases three tier. Take wine for example: Many of those retailers have shut down because they were also serving restaurants and they cannot afford the skinny margins as a result of three tiers of distribution. Then, all of a sudden, QVC starts shipping cases of wine – from the winery to the state right to the customer. QVC has become one of the largest purveyors of wine. Who saw that coming? They pivoted so quickly. There are thousands of examples like that. Large corporations that are not taking advantage of this chaos are poor managers.

Large companies should take this opportunity to steal customers from their competitors by doing everything they could to develop a direct relationship with customers because if they can build that trust, it is almost like a subscription service.

#4: Be careful and honest with investors and consumers

Throughout the process, founders should be honest with their investors and consumers, says O’Leary.

For instance, entrepreneurs should get in front of issues such as a product failing or lagging customer service. “Honest founders take the heat, tell it like it is, and ask for a chance to fix it,” O’Leary said. “Every entrepreneur goes through this, but honesty is the difference between success and failure.”