Mint’s Success: From Zero to Over 1.5 Million Users in Just 2 Years

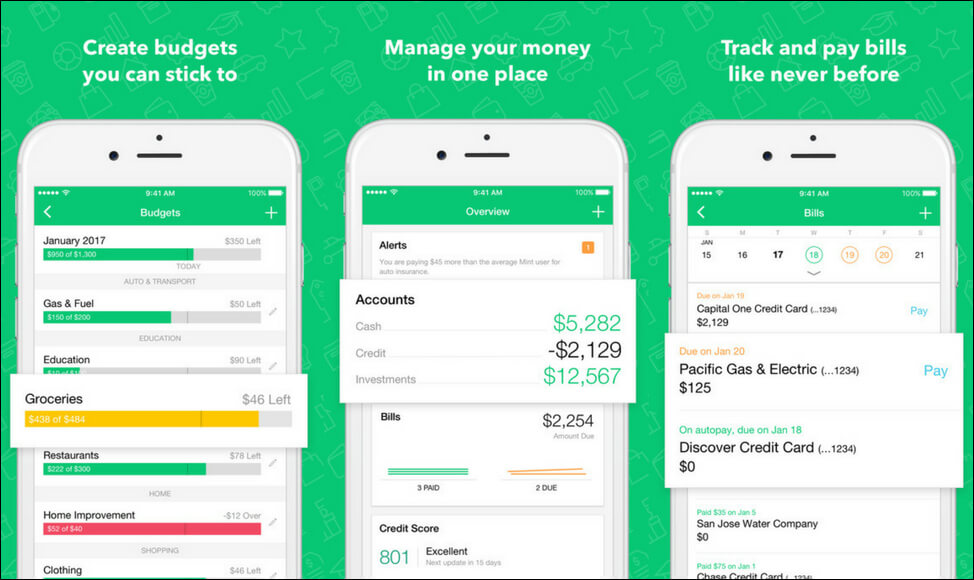

Staying on top of your finances can be a daunting and time-consuming task – Aaron Patzer knew that and ultimately decided to develop Mint.com. As a free personal finance and money management platform, Mint not only does offer a bird’s eye view of your financial situation but also provides with advice on how to improve it.

Mint officially launched in September 2007. In November 2009, Intuit bought Mint for $170 million. At the time, Mint had acquired whoppingly over 1.5 million users and was adding a few thousand new users every day. Four years later, Mint has over 10 million users.

Having grown from zero to millions of users in just 2 years, Mint proves itself to be a howling success to watch out in the exciting world of startups. So, what exactly stands behind its marvelous achievement? Which specific factors have propelled Mint to millions of users at their very first beginning? Let’s read on to uncover!

#1. Unique Approach: Different from The Start

Instead of creating a product and then iterating based on feedback, Mint founder, Aaron Patzer, went with the different philosophy: It is better to validate your idea first and if the results are positive then you should build it according to the opinions received.

“When I started Mint I took a very different approach…and this is sort of the methodology that I formed” (Validate your idea > Create a prototype > Build the right team > Raise funding).

“Number one is to validate your idea. I actually didn’t write a line of code until I did about three or four months’ worth of thinking on Mint, which I think is counter to what a lot of people will suggest. A lot of people will say ‘Just get the product out there, just iterate very, very quickly, (and) just make a prototype.’ That works for certain types of things; I think anything that is social…that works. But for finance, I wanted to be a little more rigorous and there were a lot of technical problems, connectivity to all of the banks, and the business model.”

“The next thing was to create a prototype, then to build the right team, and then to raise funding.”

Contrary to some entrepreneurs, Aaron Patzer did tell everyone he knew about his idea for Mint – and actually, out of the roughly ninety people he shared with, only one said he would use it.

From his own perspective, ideas don’t really matter, what matters is execution. “Ideas are really nothing, it’s all in the execution of that idea. Either you have a fantastic idea and you’re one of the only people in the world who can do it, or you have a fantastic idea and you have to be the best executor on that idea.”

When Patzer came up with the idea for Mint, he formed a few messaging concepts to describe it. Whereas one said something like “Mint is your Money Ninja”, another claimed “Mint is your Money Champion,” and another also said “Mint is Free Personal Money Management Software.” These were all written out on a page which explained the idea for Mint and what it did.

Patzer then went to a train station, stopped people, handed them the concepts, and asked them questions like “Does this sound like something you would use?” He suspected that people probably would say “yes” more often than they actually would use it, so he would have to gauge their enthusiasm in their “Yes” answer. If they were truly enthusiastic and genuine about their answer, Patzer would weigh that more heavily than if someone monotonically said “yes.”

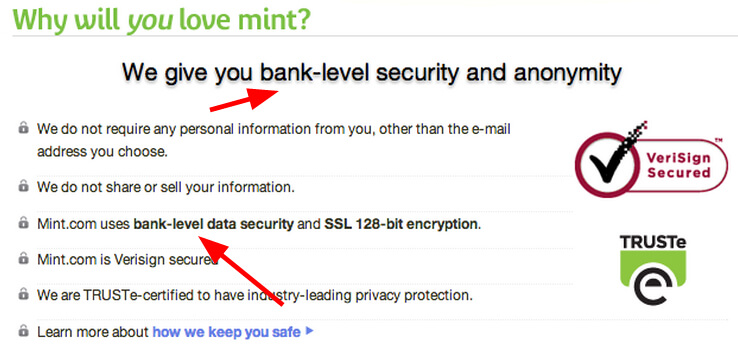

Another question he asked was about security. “Does this sound like something that is secure?” He didn’t ask if they would give them his financial information but rather asked if it seemed like a trustworthy service.

A big plus for people? Reading the words “Bank-Level Data Security” made a lot more people say they would use it. An early Mint homepage design made their bank-level security clear:

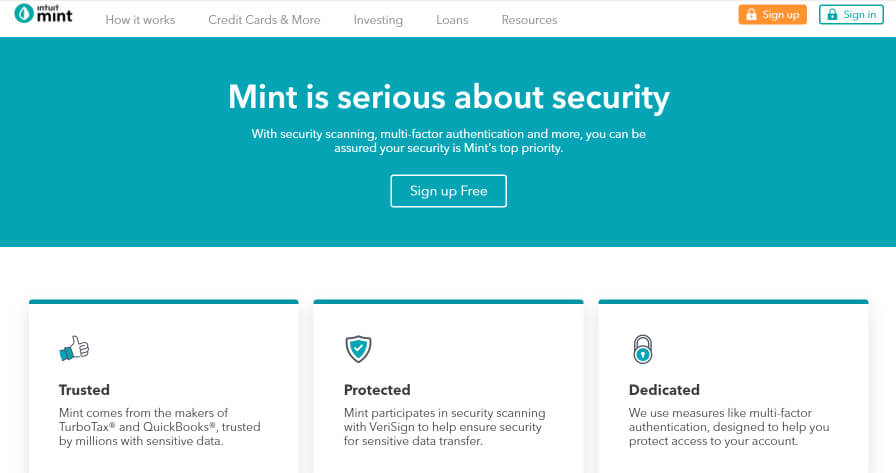

To this day, security concerns have also been well addressed on their security page:

In fact, security was a big hurdle, not just for consumers, but also for investors. Patzer says that more or less 50 venture capitalists turned him down before he got his first “yes.” But why? Simply because most of the venture capitalists didn’t think people would trust a startup with their financial and other private information.

#2. Superior Product

“That was the idea behind mint. Make it dead simple to get your finances in order and to feel in control of your life.”

– Aaron Patzer

Mint was not the first web-based money manager software. There were, actually, a few heavyweights already occupying the market – Quicken Online, Microsoft Money Online, Wesabe, Geezeo, and others.

So how could such a newcomer compete in a crowded market?

The answer is straightforward: by having a superior product. The best defense is a good offense, and Mint was able to put their competitors on their heels. It’s what you hear several business people preach:

- Rule #1 is making something people want

- Rule #2 is capitalizing on your competitors’ weaknesses

So, let’s get a little deeper into this.

To start with, the incumbents in the market had a few weaknesses. For one thing, it was quite complicated to set up an account – some had very tedious tasks for setting up and connecting accounts, and, in the end, it would take an hour for an account to be ready. To get over such an inconvenience, Mint focused on making it easy to get set up and have the program running in approximately 10 minutes.

Another area of weakness was that a large number of users often had uncategorized expenses. They’d use Microsoft Money or Quicken and when looking at their spending graphs there are at least half of their expenses falling under “Uncategorized.” Thus, users would leave with no alternative but have to manually categorize them, which could take hours every week.

To figure out a solution to such matter, Patzer worked on an algorithm that would automatically categorize expenses. Mint also had what Patzer called a “gem” – which was the goal planning part of Mint.

“Within this idea was a little gem, a little nugget. (It was) the money component of the life planning software, of the goal planning software. It resonated; people were having trouble figuring out ‘How much do I need for retirement? How much is something going to cost? How do I save up more?’ And I realized that virtually everybody I talked to had this problem and virtually everybody I talked to hated Quicken and Microsoft Money, the dominant products at the time.”

#3. Smart Marketing Strategies & Tactics

Strategy #1: Content Marketing

From Patzer’s standpoint, the marketing plan was “Whatever we can do, basically, for cheap or for free.” And a potential space that Patzer and his team actually turned to was content marketing. They started off with a personal finance blog and began building an audience for Mint.

Jason Putorti – Mint’s Lead Designer – shared that “We focused on building out a unique personal finance blog, very content-rich, that spoke to a young professional crowd that we felt was being neglected. Eventually, the blog became #1 in personal finance and drove traffic to the app. Our app didn’t have a high viral coefficient but we had content that was. Our infographics and popular articles became regular hits on Digg, Reddit, etc.”

In practice, such blogs featured various topics on finance. For instance, it wrote on “Trainwreck Tuesday” which featured disasters in personal finance. Furthermore, readers could even submit their own. Plus, they had a “What’s in Your Wallet” feature where they’d interview various people (technology CEOs, finance people, etc.) and ask them questions (for example – what card do you use, what brokerage accounts do you have, …)

Each Mint team had its own feature on the blog where they would discuss over their finances. Let’s take a look over a few team member entries:

- Aaron Patzer (Founder and CEO)

- David Michaels (VP of Engineering)

- Jason Putorti (Lead Designer)

- Poornima Vijayashanker (Software Engineer)

- Matt Snider (Lead Front End Engineer)

They held a few Q&As with personal finance bloggers (or technology people with a big reach) such as:

- Erin and Kimber of No Limits Ladies

- John of Queercents

- Leo of ZenHabits

- Monk of MoneyMonk

- Shelley Elmblad of About Financial Software

- Joel Mueller of MacUpdate

To attract more and more traffic, their featured categories have been prominently placed on the blog:

What’s more, Mint teams developed a strong beta list when visitors left their emails at the end of every blog post. In fact, they built up this demand for around 8 to 9 months. Over this time, they accrued about staggeringly 20-30k emails. Such a figure became just too many as the system could handle only a couple of hundred; thus, Mint told their users they could have special access (alpha) if they put a badge on their blog or social media page – the badge simply said “I want Mint.” And actually, to this day, they still have badges available.

Then, Mint granted exclusive VIP access to all of the people who had the badge embedded. From this badge, Mint got free advertising on 600 different blogs as well as an SEO boost due to links pointing to Mint.com.

Besides these efforts, Mint successfully managed to have a myriad of personal finance bloggers write on the Mint blog for free so long as their site was linked back. They also sponsored personal finance blogs. As a result, Mint had more traffic than all other personal finance sites combined by the time of launch.

Strategy #2: PR

Undoubtedly, almost all their blogging and content marketing efforts were flourishing. But perhaps what had a greater effect than their content marketing strategies was PR, which – Patzer says – was their best way to “pull” new users.

The Mint’s founder spent, on average, 1 week out of every 2 months doing a press tour. By the time of the acquisition, Patzer had done about 550 interviews.

When it came to their PR efforts, Putorti explained:

“Some entrepreneurs lately seem to be piling on against PR or saying that doing it in house is enough. Mint is an example where we (they used Atomic PR) did extensive PR-backed positioning research and went to town. PR was extremely high-quality traffic for us, and the optics for the brand were undeniably good. We trounced all of our online competitors, including Quicken, who sent us legal threats. Patzer talked to every outlet from Entrepreneur to Essence.”

Based on Atomic PR, it was clearly pointed out that their efforts led to an impressive 255% increase in coverage, as many as 20,000 signups in a day, and the fastest-growing personal finance software product. There is no denying that Mint deserved to be one of the most typical examples which have got its feet off the ground with PR.

So, all in all, how successful were Mint’s marketing and PR efforts? According to Patzer, they became so efficient that their cost of acquisition was under $1.

Strategy #3: SEO

“People trust Google, so we knew they’d trust us more if they came to Mint from there, so we used search engine optimization to get Mint to the front page of Google searches.” -Noah Kagan

Another area where Mint pursued an aggressive strategy was SEO. Their SEO efforts drove around 20% of total new users to Mint.

To be more specific, let’s go over a few programs they did to get search traffic:

- Blog Posts

The Mint blog, in addition to getting social traction, also drove traffic from search engines. Running a quality blog is, by all means, central to successful content marketing.

- Mint Answers

In May 2010 Mint launched Mint Answers, a platform similar to Yahoo Answers, Stack Overflow, or Quora. The key difference is that Mint hired a panel of experts (known as the ACA) to help answer questions. Further to the panel, Mint users could chime in with their own answers.

So when people go searching for a query such as “Should I lease a new car?” Mint may be one of the first results. Should you try looking for Mint Answers, you may find some of the archives, but the platform has since been shut down.

- Optimized Landing Pages

“We had a lot of landing pages, content on the blog and marketing sites, and a very metrics-driven approach to all of it. For every popular finance query on Google, we had a page and content for it, and iterated landing pages to optimize conversion.” – Putorti explained.

Strategy #4: Facebook & Twitter

Mint also added the “personal and human side” to their business by adopting Facebook and Twitter effectively. Their teams had discussions with people who would comment on their page, held giveaways as well as actively promoted their blogs through these social channels.

Mint became more than just a product. It became a place for all things of the finance world – to talk finance, trade stories, share advice, and much more – which ultimately has made mint a financial centerpiece of your life!

The Bottom Lines

As an intuitive tool for individuals to deal with their financial tasks, Mint turns out to be a jaw-dropping success in the challenging world of entrepreneurship. Its brilliant product as well as the well-crafted marketing strategies stand out to be the key factors contributing to such fast growth.

Should you be a finance enthusiast and pursue a dream to step in the financial landscape, Mint’s success story is what you definitely should learn from.