Robinhood App: Are Commission-Free Trades Worth It?

Since the advent of fintech, short for financial technology, the financial services industry has been turned on its head. Whether you’re going to simply buy coffee at your local coffee shop, manage your finances or consider for a serious investment decision, fintech is all around us.

With such digital dominance of fintech these days, investors are granted endless options to trade everything online or through mobile apps. Among dozens of powerful trading apps and platforms, Robinhood stands out as one of the fastest-growing options for low-cost (or free) online investing.

Before going into great details about Robinhood, its outstanding features as well as major concerns, let’s take a quick look at its operational history.

How Was Robinhood App “Born”?

Robinhood is the brainchild of founders Baiju Bhatt and Vladimir Tenev, who had previously built high-frequency trading platforms for financial institutions in New York City.

In December 2013, Robinhood launched out of stealth on the crowdsourced technology news website Hacker News, leading to several articles in TechCrunch, PandoDaily, VentureBeat, TheStreet, and others.

In the wake of the 2008 financial crisis, Robinhood was conceived out of a great desire to “democratize America’s financial system” as well as disrupt online investing by providing a platform for the younger generation of jaded investors. Named after the fictional character Robinhood – who robbed the rich to feed the poor – the investment app was designed to give the next generation inexpensive access to trading that could help them get involved earlier in the market. Taking on a proverbial “not like the other guys” mentality, Robinhood has attracted a large millennial base to use the low-to-no-fee app – especially for high-frequency traders. In fact, since its launch, Robinhood has seen a meteoric rise in popularity, reporting some staggeringly 6 million users.

As with any fintech company or digital stock brokerage, there always remain lingering questions: Is Robinhood app safe? What are the intangible risks involved with this trading app? Or, what should you consider carefully before investing with it in 2019 and beyond?

Robinhood and Its Excellent Features

To put it simply, Robinhood is a commission-free investment and stock-trading app, allowing users to invest in stocks, ETFs, options, cryptocurrency and more. Boasting a fee-free model, this app grants you a golden opportunity to trade stocks and other securities without any cost.

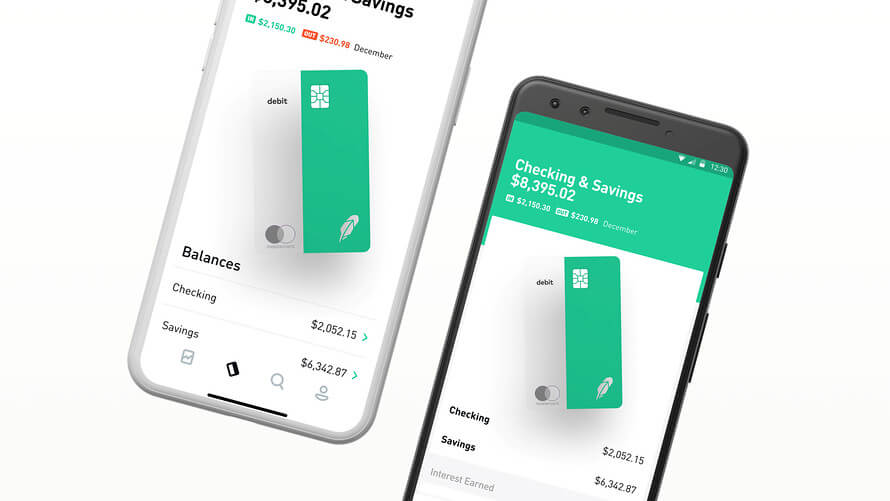

Robinhood was first launched with Apple phones and products but has since developed Android versions as well. And, not surprisingly, Robinhood on Android is just as nice to look at as its iOS incarnation. Furthermore, it is intuitively designed for newcomers and experts alike; thus, no manual is needed to get on well with such a wonderful app.

Besides, as part of its easily-accessible and trading-for-the-people model, Robinhood doesn’t require any account minimum to trade and offers commission-free trades for all users. In addition to the variety of trading offerings as above-mentioned, it also offers Robinhood Gold – the premium account that allows users margin to trade.

Overall, Robinhood’s commission-free model, a decent range of investment products as well as its user-friendly app and streamlined interface have made it increasingly popular, especially among a younger demographic.

Let’s take a glance at below Nerdwallet’s review to have a wider view about this fintech app:

| Account minimum | $0; $2,000 for Robinhood Gold margin account (regulatory minimum) |

| Stock trading costs | Free |

| Options trades | Free |

| Account fees (annual, transfer, closing, inactivity) | No annual, inactivity or ACH transfer fees. $75 ACAT outgoing transfer fee |

| Number of commission-free ETFs | Over 2,000 ETFs |

| Number of no-transaction-fee mutual funds | None |

| Tradable securities |

• Stocks • ETFs • Options • Cryptocurrency • American Depositary Receipts for over 250 global companies |

| Trading platform | The Web platform is purposely simple but meets basic investor needs |

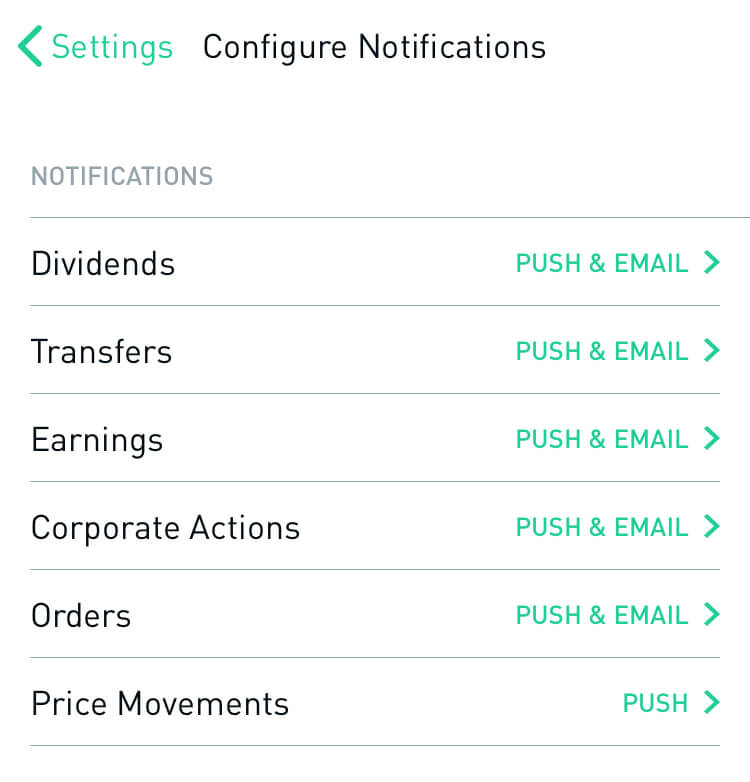

| Mobile app | Mobile trading platform includes customizable alerts, newsfeed, candlestick charts and ability to listen live to earnings calls |

| Research and data | Free but limited (Though Robinhood’s research offerings still pale in comparison to other brokers, it has made strides to increase the tools and research available for customers) |

| Customer support options (includes website transparency) | Almost exclusively done through email (Email support Monday – Friday) |

| Promotion | Refer a friend who joins Robinhood and you both earn a free share of stock. |

But again, given these excellent features, is Robinhood app safe?

A Major Concern: Is Robinhood App Safe?

Robinhood, like all brokerage firms that handle securities, is regulated by the Securities and Exchange Commission (SEC). In addition to SEC regulation, Robinhood has several other safety measures in place to protect users’ money as well as their sensitive personal information. In fact, the app is a voluntary member of the Financial Industry Regulatory Authority (FINRA), a self-regulatory body that many brokerages are members of.

What’s more, money on Robinhood is protected up to $500,000 for securities and $250,000 for cash claims, ensuring investors can trade with peace of mind. Also, such an amount of money is strictly safeguarded by the Securities Investor Protection Corporation (SIPC), making this app a highly credible option for investors.

One noteworthy point is that whereas Robinhood operates under a decent amount of regulation and protection as an online investment brokerage, it is not a bank. When the regulations and insurance do make Robinhood app safer to use, there are other vital factors to consider apart from mere security when it comes to fintech app’s safety.

In fact, according to Tara Falcone, a financial planner and analyst and also the founder of financial education company ReisUP LLC, whereas Robinhood already boasts some benefits of commission-free securities trading for a younger generation, the app is not without its dangers.

“Apps like that, especially ones that are reducing trading costs, or in this case having zero commission trades, are great from an accessibility standpoint,”

Falcone said.

“One thing that has previously kept a lot of small investors out of the investing game is the fact that they had to pay a broker. However, I do think that targeting the millennial generation, which are very instant-gratification driven, can be a little dangerous when you’re considering the mix of investments and different investment strategies that are available through an app like Robinhood versus through another fintech app such as Acorns or Stash.”

Dangers to Fresh Investors

Apart from several mentioned regulations and security measures put in place to shield users from any safety concerns, there is an additional matter around Robinhood’s format and layout. Whereas it may not directly pose a tangible threat to investors’ money in terms of security, some financial experts, including Falcone, claim Robinhood’s layout and model might be more of a potential danger to beginner or novice investors.

The app has actively and largely marketed itself to millennials as the new and easy-to-use investment tool for beginners, which, according to some, is precisely the problem!

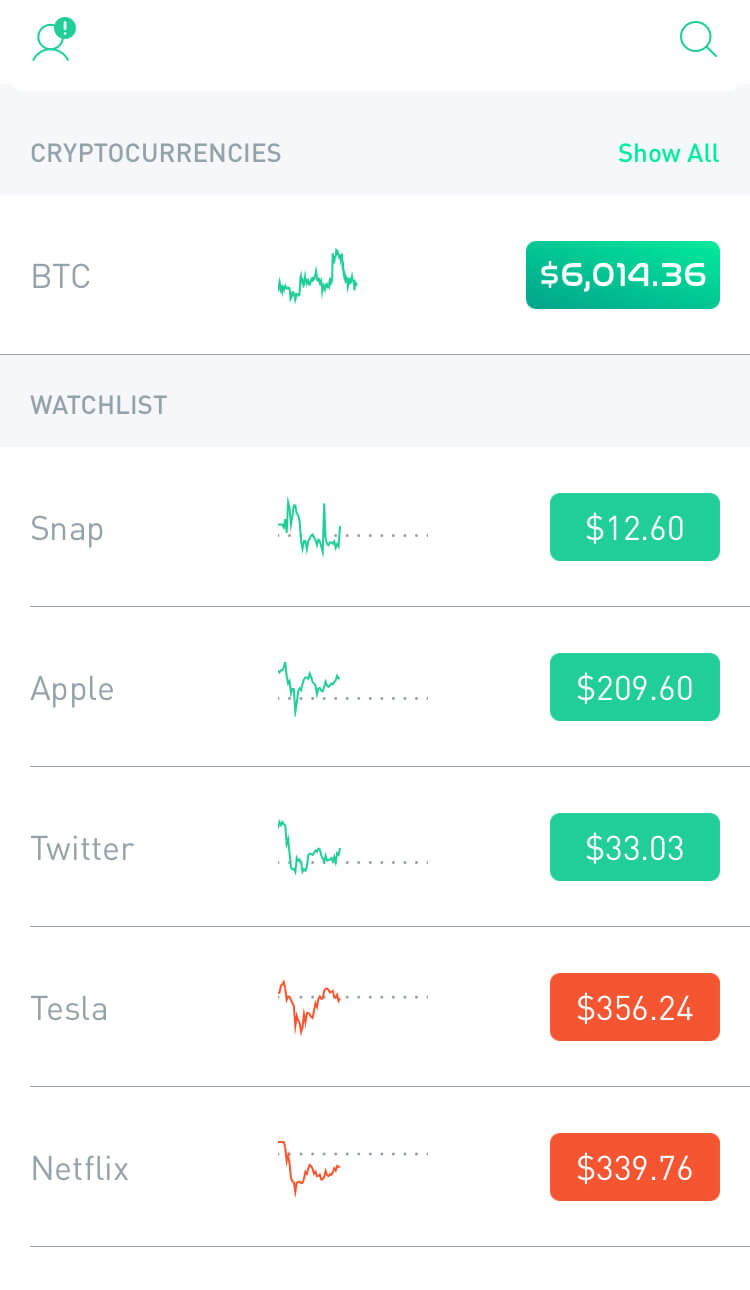

In fact, MONEY called Robinhood simply “day trading for the mobile era,” stating that the app’s heavy emphasis on high-frequency trading of flashy stocks compared to low-risk funds or ETFs, among other risky factors. Despite the fact that Robinhood allows customers to create diverse investment portfolios of U.S. stocks, ETFs, options, as well as six different cryptocurrencies on its entire platform, Robinhood is set up to encourage stock-picking. When you sign up for the app, a list of popular stocks appears like Apple, Microsoft, Tesla, Netflix and even well-known cryptocurrencies – a historically volatile investment – like Bitcoin appears on your screen. You won’t see low-cost, diversified ETFs on that list. Should you decide on investing in a fund, you need to find the fund yourself.

In general, stock-picking isn’t for amateurs. Robinhood’s encouragement to beginner investors to get involved in such a dangerous game can be seen as its major pitfall.

As featured in TheStreet., for Falcone, who is in the business of increasing financial literacy, such type of promoted strategies and the offerings Robinhood has are potentially questionable.

“The [strategies] that I’m primarily speaking of are not just individual stocks but more so on the side of being able to trade cryptocurrency, to trade on margin, to be able to participate (in some cases) in early mornings of IPOs that I think are much more speculative and get a lot more media and news attention, and are therefore kind of more attractive or enticing for a novice investor who maybe hasn’t dipped their toes in the investing waters before or maybe the only experience with investing they’ve had so far is in their 401(k) – which, for a lack of a better term, is kind of boring.”

Falcone told TheStreet.

Plus, the app seems to encourage frequent trading by “celebrating” trades with things like confetti on the interface, as well as push notifications about changes in the stock. It is this combination of promoted stocks and constant updates that – many experts believe – makes Robinhood a bit riskier for novice investors who just jump into the world of financial investment.

Understandably, it’s suggested (by some) that Robinhood isn’t the easiest platform to hold a diversified portfolio, being more geared toward users with very few stock positions with potentially higher risk.

Apart from these kinds of investments offered on the app, Robinhood isn’t necessarily the most educational app either, from Falcone’s perspective.

“From a media perspective or what I see them promoting, … I don’t necessarily see a focus on education on their website – it says, in quotes, ‘learn by doing, … Depending on what that first step is or what it is that you’re doing, it could be a pretty harsh learning experience from the get-go, whereas other fintech apps like Stash, for example, have a greater emphasis on education and teaching you what you’re doing along the way.”

Falcone shared.

What’s more, given its free trading model, there has remained some speculation over how Robinhood makes money. Let’s see!

How Does Robinhood Earn Money?

Whereas Robinhood doesn’t collect direct fees or commissions from trading, the app does make money through a variety of other channels including interest, premium accounts, high-frequency trading and order flow and rebates.

1. Interest

According to one the co-founders of Robinhood, the app makes a large portion of its revenue from interest made by lending out investor’s idle cash – basically making money off of uninvested funds in customer’s accounts. Much like a bank collects interest on cash deposits” as well as “rebates from market makers and trading venues”, Robinhood make a fast buck with interest from customer cash and stocks.

Plus, this charges for some other services, including live broker trading via phone (which will put you back $10 per trade) as well as some foreign stock transactions for around $35 to $50.

What’s more, Robinhood also reportedly makes a decent bit off of trades in other ways such as making money off of orders. According to the Wall Street Journal in late 2018, “If a customer buys 100 shares of Apple for $200 each – a $20,000 purchase – Robinhood could get up to $5.20 for routing that order to electronic-trading giant Citadel Securities LLC, according to calculations based on a recent Securities and Exchange Commission filing.”

2. Marginal Interest and Margin Lending

A major source of income for this investment app is the company’s margin trading service via its premium accounts: Robinhood Gold, which is designed for investors up to $1,000 of margin, allowing them to trade with more than they have in their cash balance on the app.

Once signing up for Robinhood Gold, your account will be charged the $5 monthly fee every 30 days at the beginning of each billing cycle. If you use more than $1,000 of margin, you’ll pay 5% yearly interest on the amount you use above $1,000. Your interest is calculated daily and charged to your account at the end of each billing cycle.

Besides, should users wish to switch their Robinhood account to another broker, they will need to pay $75.

3. High-Frequency Trading and Order Flow

The app has come in for some criticism over its dependency for revenue on high-frequency trading and a strategy so-called payment for order flow.

Based on Bloomberg’s report in late 2018, Robinhood was bringing in nearly half of its revenue (more than 40%, to be more specific) earlier this year from selling its customers’ orders to high-frequency trading firms, or market makers, like Citadel Securities and Two Sigma Securities. Almost all retail brokerages employ such a practice, but it’s an unlikely strategy for a company built on an anti-Wall Street message – which possibly creates a conflict of interest where consumers can lose out.

Following questions about the practice from Bloomberg, Vladimir Tenev – Robinhood’s co-founder – replied in the letter, posted on the company’s blog:

“We send your orders to the market maker that’s most likely to give you the best execution quality … For even finer control, we offer limit orders and stop limits, which allow you to name your own price.”

4. Rebates

Whilst the payout is reportedly minimal, Robinhood does earn some money from rebates. Of the pricing, Tenev said, “Robinhood earns ~$0.00026 in rebates per dollar traded. That means if you buy a stock for $100.00, Robinhood earns 2.6 cents from the market maker.”

Also, he explained that such rebates allowed the company to charge consumers less, “Robinhood’s zero-commission model has unlocked the ability for every American, not just large institutions, to participate in a variety of investing strategies that were previously economically unfeasible.”

Because of the company’s boundary-pushing revenue streams, some suggest its reliance on rebates may someday be to its detriment.

“Robinhood’s revenue model could easily disappear,” Tyler Gellasch, an executive director of Healthy Markets (an investor advocacy group), told Bloomberg in 2018. “They’ve made it clear that they are comfortable living on this regulatory edge.”

The Bottom Lines

So, should you go ahead with such an investment app or steer clear? Actually, that decision is largely based on the kind of experience, knowledge, and goals you have.

As Robinhood grants you several excellent features as well as addresses your safety concerns with many security measures put in place, the app does pose some intangible threats, especially to young or inexperienced investors.

Still, among the numberless of security-trading platforms, Robinhood is generally rated high for safety and well worth your investing consideration. It’s never too late – or too early – to plan and invest for the future you deserve as long as you are 100% sure to get well prepared before jumping in such a dangerous game of financial investment.