NVIDIA’s Success: The Rise of a Santa Clara-Based Tech Behemoth

Should you have ever wondered how a not-so-stellar startup can compete with large incumbents like Intel, then NVIDIA will be an outstanding case for you. Founded in 1993 with humble beginnings, NVIDIA is considered one of tech’s hot prospects, becoming the leading designer of graphics processors commanding more than 70% of the GPU market just by 2017 along with setting the standard for digital content creation in product design, movie special effects and gaming.

In mid-1990s NVIDIA’s products were deemed to be a failure. Fast forward to today, NVIDIA strives to be one of the most impressive tech behemoths with the big ambition to conquer the semiconductor market in PC and server space. So, how in the world could this 27-year-old chipmaker “hit the jackpot”? How is its growth trajectory? What has been the key driving forces behind NVIDIA’s stunning success? And how about some of its strategic moves recently? Let’s read on to explore.

The Rise of NVIDIA – The Santa Clara-Based Behemoth

#1. The Notable Growth Trajectory of the 27-Year-Old Chipmaker

Co-founded in 1993 by Jensen Huang – who’s still managing the company – NVIDIA, at the time, was just one of around two dozen graphics chip companies. After all of its rivals have been acquired, folded or become part of larger companies, this Santa Clara-based company becomes the only independent maker of these components.

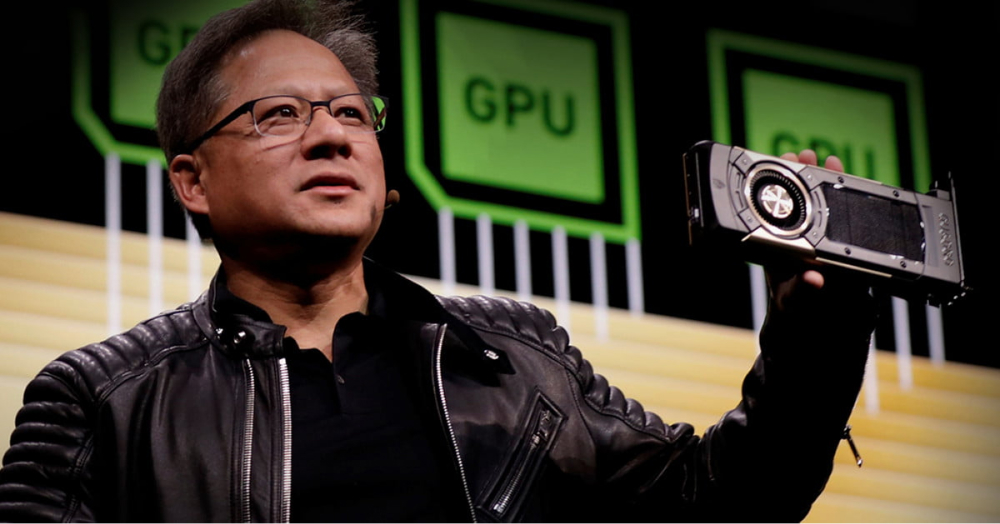

When it comes specifically to chip-making sphere, NVIDIA was more successful than its peers at developing chips that turn computer code into the realistic images that gamers love. Actually, under Huang’s charismatic leadership, the business has pushed that technology into new markets, such as data center servers and artificial intelligence processing. Then, in just five years, its data center business has grown from $300 million in annual revenue to almost $3 billion. By successfully arguing that graphics chips can handle AI workloads better than more standard processors, the chipmaker has won orders to equip countless giant computing factories, especially ones owned by companies such as Facebook Inc. and Google.

Beyond any doubt, NVIDIA’s striking success makes it stand out in a chip industry that has experienced a steady decline in sales of personal computers and a slowing in demand for smartphones. Up to now, this 27-year-old chipmaker is the only company to have made sizable inroads into a server chip market that Intel has mostly dominated. Whereas Intel – the world’s largest chip producer and a maker of the semiconductors that have long been the brains of machines like PCs – still generates more than $20 billion in quarterly sales and maintains a solid revenue growth of 9 percent in the most recent quarter, NVIDIA is growing much quicker.

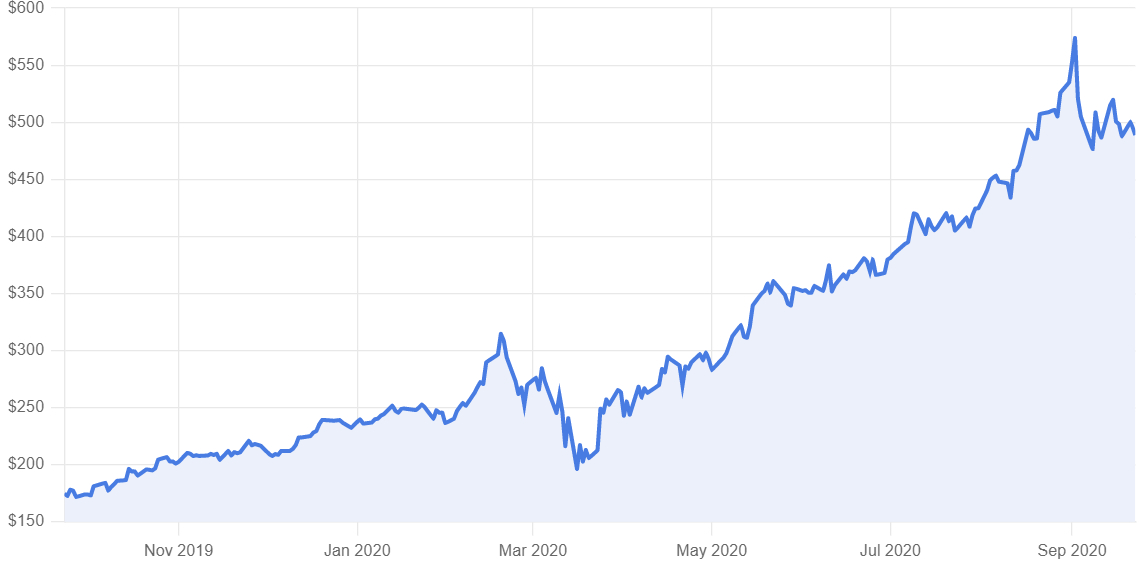

Actually, investors have rewarded such a fast expansion with a rich valuation. Since debuting on the Nasdaq in 1999, the stock has averaged an annual return of 33%. In the past five years, whilst Intel shares trade at 12 times earnings, NVIDIA has soared more than eightfold and trades at whoppingly 75 times earnings, according to data compiled by Bloomberg. Especially in this year, NVIDIA’s stock price markedly increased from $192.01 at the end of 2017 to $462.56 currently, witnessing a dramatic increase of more than 140%.

“They are just cruising,” Hans Mosesmann, an analyst at Rosenblatt Securities, said of NVIDIA, which he has tracked since it went public in 1999.

#2. Jensen Huang & His Big Bet on Success

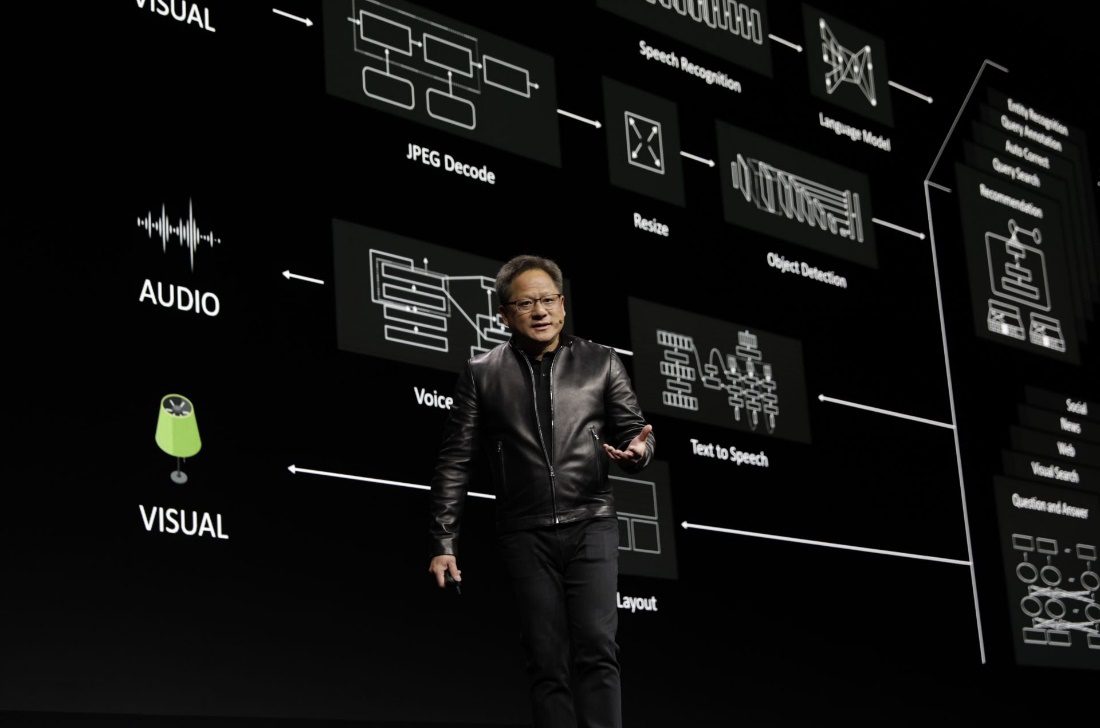

Driving the surge is no one other than Jensen Huang, the NVIDIA founder, and the company’s chief executive, whose strategic instincts, demanding personality, and dark clothes prompt comparisons to Steve Jobs. Mr. Huang made a pivotal gamble more than 10 years ago on a series of modifications and software developments so that GPUs (Graphics Processing Unit) could handle chores beyond drawing images on a computer screen.

“The cost to the company was incredible,” told Mr. Huang, who estimated that NVIDIA had spent staggeringly $500 million a year on the effort, known broadly as CUDA (Compute Unified Device Architecture), when the company’s total revenue was around $3 billion. Additionally, NVIDIA puts its total spending on turning GPUs into more general-purpose computing tools at nearly $10 billion since CUDA was introduced.

The CEO bet on CUDA as the computing landscape was undergoing broad changes. And fortunately, such a bet did pay off. “At no time in the history of our company have we been at the center of such large markets,” Huang says in the company’s headquarters in Santa Clara, California, where he’s in his trademark all-black outfit – black leather shoes, black jeans, black polo shirt together with an irreplaceable black leather jacket. “This can be attributed to the fact that we do one thing incredibly well – it’s called GPU computing.”

#3. NVIDIA & Its Current Performance

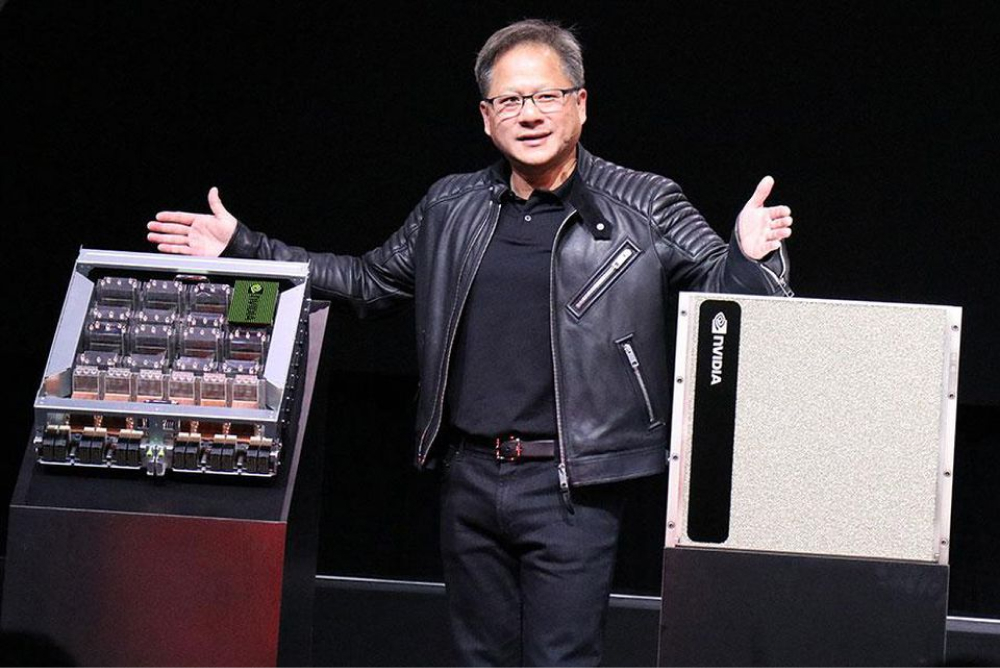

Based on the latest sales report, the chip company reveals record-breaking revenue amid the launch of new server chips, generating whoppingly $1.75 billion of data-center sales in the second quarter – the figure turns out to be more than double last year’s total of $655 million and ahead of the average analyst expectation of $1.71 billion. The data-center segment is especially crucial to investors after NVIDIA announced its latest Ampere-architecture-based offering for servers earlier this year.

Powered by soaring demand for graphics chips in data centers and other fast-growing technology fields, NVIDIA’s market valuation did top Intel Corp.’s for the first time. While Intel shares have fallen 2% in 2020, shares of the graphics chipmaker are up 72% so far this year and investors bet the coronavirus pandemic has accelerated a shift to cloud-based digital services that employ its technology. For the time being, NVIDIA emerges as the world’s third-largest chipmaker by market capitalization – standing at more than $248 billion – behind Taiwan Semiconductor Manufacturing Co. and Samsung Electronics Co.

With a huge boost in NVIDIA’s data-center business in the second quarter, this is also the first time when the revenue from server chips outpaced its gaming business. With both data centers and videogaming fueled by the work-from-home trend in the ongoing global pandemic, NVIDIA is in a sweet spot with both of those businesses.

“We find ourselves really in this perfect condition, where the future is going to be more virtual, more digital,” Jensen Huang told analysts on a conference call.

Although server business eclipses gaming chips, that trend may not last: actually, new gaming chips amid a pandemic-influenced boom in videogames are expected to flip that back around and produce even more record sales. To be more concise, when asked in a brief interview after the analyst call if Huang is going to introduce new gaming chips, Chief Financial Officer Colette Kress did not deny that NVIDIA plans to introduce new gaming products, and said it would be an “opportunity to update the market on new products, but also new things in the development world.” Also, she did note that the company plans events for the rest of this month leading up to its upcoming GeForce special event by early September.

It seems that the tech behemoth intends to foster competition between both businesses internally. Last quarter, the data center was the star, with sales of chips for data centers surging 80% and the company creating a new segment-reporting structure. Now, with Nintendo Co. Ltd. manufacturing new Switch consoles for the holidays and computer manufacturers pushing out new laptops for back-to-school sales and the holidays, Kress said she expects gaming to take the title back in the current quarter.

“We have to keep both of these businesses on their toes and racing,” Kress enthusiastically shared. “Watching them trade off once in a while is a great thing.”

Besides, she highlighted that video gaming has become one way for a wide range of age groups to socialize virtually, in the shelter-in-place world of today. “It is an entertainment form like no other,” she stated, adding that there is not a lot else to do for some stuck at home missing their friends. “You really can’t do much, but amazingly the sport of gaming is right there and continuing to attract users from all over the world…. [from] teenagers, young adults, to others.”

Given the fact that other major videogame-console makers, especially Sony and Microsoft, are expected to refresh their gaming consoles with new Advanced Micro Devices chips, the NVIDIA’s CFO said that she looks forward to the new games developed for those consoles, which are likely to also head for PCs. The new consoles will raise the tide for the entire videogame industry, including NVIDIA.

“I think it’s going to be quite a huge second half of the year,” shared by Mr. Huang shared, told analysts, when asked about what videogame platforms he was excited about.

Going forward, investors may feel like they are watching a tennis match with the rivalry between the two business units, watching the ball go from one side to the next, quarter to quarter — but clearly, that’s what this company desires. As long as both the videogame business and the data center keep growing, NVIDIA will definitely be the overall winner, no matter which segment comes out on top.

NVIDIA’s Acquisition of Arm For $40 Billion: The Ambition to Conquer the Semiconductor Market

By September 13, NVIDIA and SoftBank Group – or SBG, for short – announced a definitive agreement, under which NVIDIA will acquire Arm Limited from SBG and the SoftBank Vision Fund (together, “SoftBank”) in a transaction valued at $40 billion. The transaction is expected to be immediately accretive to NVIDIA’s non-GAAP gross margin and non-GAAP earnings per share. Should it be completely closed, this would turn out to be a hugely significant deal for the tech world, with implications that will take years to unravel spanning many areas of the sector. This would be the largest semiconductor deal of all time by dollar value – yet, the dollar value may actually understate the importance of the deal.

Undoubtedly, Arm is at the heart of nearly every smartphone sold today, from Apple iPhones to Samsung Galaxy devices running Google’s Android software. In addition to smartphone processors, Arm technology is adopted in a plethora of smaller chips integrated into all kinds of computer systems and devices.

“They’re in everything, and they power computers of all different types of shapes from the fastest supercomputer in the world, to smartwatches and smart thermostats,” NVIDIA CEO Jensen Huang told CNBC on September 14.

UnitingtheNVIDIA’s leading AI computing platform with Arm’s vast computing ecosystem, such a combination is expected tocreate the premier computing company for the age of artificial intelligence, accelerating innovation while expanding into large, high-growth markets.

“AI is the most powerful technology force of our time and has launched a new wave of computing,” stated CEO Jensen Huang. “In the years ahead, trillions of computers running AI will create a new internet-of-things that is thousands of times larger than today’s internet-of-people. Our combination will create a company fabulously positioned for the age of AI.

Simon Segars and his team at Arm have built an extraordinary company that is contributing to nearly every technology market in the world. Uniting NVIDIA’s AI computing capabilities with the vast ecosystem of Arm’s CPU, we can advance computing from the cloud, smartphones, PCs, self-driving cars and robotics, to edge IoT, and expand AI computing to every corner of the globe.”

On the SBG’s side, Masayoshi Son, its chairman, and CEO shared, “NVIDIA is the perfect partner for Arm. Since acquiring Arm, we have honored our commitments and invested heavily in people, technology, and R&D, thereby expanding the business into new areas with high growth potential. Joining forces with a world leader in technology innovation creates new and exciting opportunities for Arm. This is a compelling combination that projects Arm, Cambridge, and the U.K. to the forefront of some of the most exciting technological innovations of our time and is why SoftBank is excited to invest in Arm’s long-term success as a major shareholder in NVIDIA. We look forward to supporting the continued success of the combined business.”

Furthermore, “Arm and NVIDIA share a vision and passion that ubiquitous, energy-efficient computing will help address the world’s most pressing issues from climate change to healthcare, from agriculture to education,” said Simon Segars, CEO of Arm. “Delivering on this vision requires new approaches to hardware and software and a long-term commitment to research and development. By bringing together the technical strengths of our two companies we can accelerate our progress and create new solutions that will enable a global ecosystem of innovators. My management team and I are excited to be joining NVIDIA so we can write this next chapter together.”

From the investors’ standpoints, they believe that NVIDIA could closely integrate Arm’s CPU technology with NVIDIA’s specialty in graphics processors (GPU) to build a lead on the rest of the semiconductor industry. Jefferies analyst Mark Lipacis firmly believed that the deal could let NVIDIA bolster its data center business by creating an “ecosystem” of server chips and software ranging from Arm-based CPUs to its GPUs. NVIDIA could more closely integrate Arm processors into its products, increasing performance without using additional power. Actually, it could also entrench NVIDIA and make it harder for competitors to steal business.

“With Arm, we think NVIDIA is poised to also offer general-purpose, heterogeneous data center scale solutions and ultimately capture up to 80% of the value of the serial processing part of the data center ecosystem,” Lipacis wrote. “We also think that Arm gives it a larger moat in the data center.”

CNBC’s Jim Cramer also supposes that NVIDIA’s move to purchase Arm would cement the company as the dominant player in the semiconductor industry, making it a ‘game, set, match’ for its battle with Intel as well as other chipmakers within the sphere.

Tracking back a little bit, NVIDIA once had big ambitions to make CPUs for phones but had little success. If completed, the transaction would instantly transform NVIDIA into one of the most influential players in smartphone technology, a market that had previously eluded it. Yet, it appears that at least initially the focus should be on data centers. “What will change is the rate of our roadmap. We know for sure that data centers and clouds are clamoring for the Arm microprocessor, the Arm CPU,” Huang told Forbes. “Energy efficiency directly translates to computing capacity, computing throughput, and the cost of provisioning service.”

Of course, the purchase will prompt regulatory scrutiny by antitrust authorities around the world, particularly for an environment that’s less friendly to mergers than at any time in recent memory. Nonetheless, the fact that NVIDIA and Arm don’t directly compete could be helpful in avoiding anti-trust problems and smoothly navigating that process.

The Bottom Line

Whereas the semiconductor sphere is a tough market with little product differentiation and requiring pricey R & D efforts, NVIDIA managed to achieve major breakthroughs and ride on the crest of the wave. Starting out with humble beginnings, NVIDIA has grown into one of tech’s hottest prospects, arming itself to terminate Intel’s processor dominance and conquer the semiconductor market.