The Complete Guidance for Small Business Bookkeeping

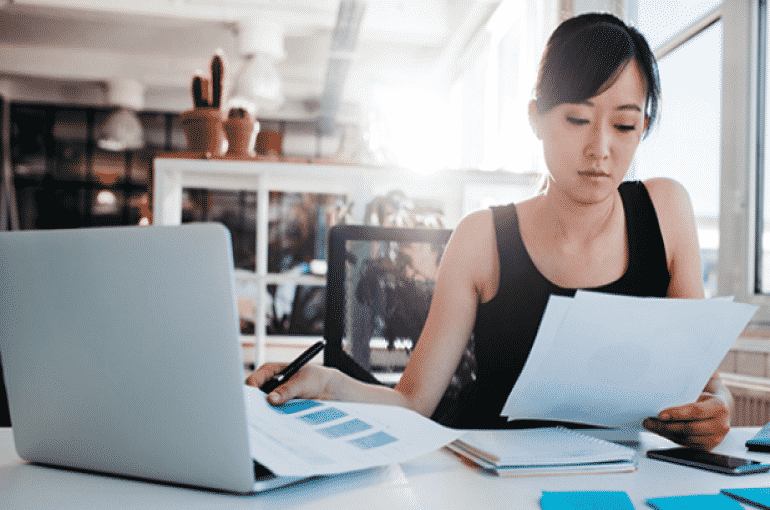

In the months or years since you first became a business owner, how many times have you been told you need bookkeeping services? If you’re like most business owners, the answer is probably, “A lot” .

If you have ignored that problem this far, it might be a good time to start doing your research before you dig the hole any deeper, because a bookkeeping does more than just record payables and receivables, they guarantee the security, power and success of your business. Therefore, today, in this article, we will discuss all the small business accounting issues along with important tips to help you understand and promote your small business right now and be able to succeed in the future.

What is bookkeeping?

Bookkeeping in a business firm is the basis of the firm’s accounting system. Bookkeepers are responsible for recording and classifying the accounting transactions of the business firm such as business assets, liabilities, income and expenses as well as techniques involving recording those transactions.

Why is small-business bookkeeping important?

1. Having a Better Cash Flow

By recording your transactions and business events, you will be able to plan ahead and make things a lot easier. You will also be able to meet deadlines and pay everything in time. A small business needs to have an effective cash flow management in order to grow. You can ensure this for your business with proper bookkeeping.

2. Performing Business Evaluations

You will also be able to make an evaluation of your business in order for you to know if the business is growing or not. Knowing where you are with the business at a certain point in time can help you to develop different strategies and make changes to improve it.

3. Developing Performance Charts

Small business owners must know when to increase the number of their employees and bookkeeping can help them to understand when it is the best time to do this. You will be able to make comparisons between the current financial status of the business and its status from the previous years. In this way, you can analyze the growth and the losses and then create charts. The growth rate of your business can be established based on these charts.

4. Ease of Paying Taxes

Another important aspect that is directly connected to bookkeeping is the way you pay your annual taxes. If you have an organized balance sheet and you know everything about the cash flow in your business, calculating annual taxes becomes easy. You will not have to search for all the bills and always be in a rush because of this. You will also spare your tax adviser some efforts and time. Instead of correcting your statements, the adviser will now be able to provide tax-related advice.

5. Ease of Reporting to Investors

Bookkeeping can help you to avoid the hassles that are usually involved in reporting to your investors. Now that you have all the charts, lists and information prepared, all you have to do is present these materials to your investors. Bookkeeping allows you to keep everything well-organized. This is not only beneficial for your relations with investors, but also in case of an audit.

How to do bookkeeping for small business

Now that you understand what bookkeeping is and why it’s important for small businesses, let’s get down to the details.

These are the four basic steps to small-business bookkeeping:

Step 1: Setting Up Your Accounts Payable

1. Save proof of business expenses

Accounts payable is the amount of money you owe other people for business expenses. If you buy inventory or supplies, then you’ll need to collect proof of the expense. You’ll also need this information later at tax time. Save the following:

- bills

- receipts

- bank statements

- credit card statements

- proof of payment

- any other documentary evidence

2. Set up a spreadsheet or ledger

You’ll need create an electronic spreadsheet or ledger on a piece of paper. If you don’t want to do this yourself, there is bookkeeping software you can purchase that will make bookkeeping easy.

3. Create columns for necessary information

You’ll include the following information on your spreadsheet or ledger, so create a column for each:

- supplier’s name

- account number

- type of expense (e.g., office supplies, professional services, etc.)

- date you received the invoice

- amount you owe

4. Post information daily

It’s important not to overlook accounts payable and forget to include them on your spreadsheet. Get in the habit of posting information daily. If you have few expenses, then you might want to post only weekly or monthly, but it’s key that you remember to develop a routine.

5. Pay your bills in a timely fashion

Remember to pay bills frequently—on a weekly basis is ideal. Don’t wait until the due date. Instead, give yourself a few days in advance of the deadline.

Paying bills early is a good way to maintain effective relations with your vendors.

However, if you’ve been hired by a business to work as a bookkeeper, then paying on time is a necessity for maintaining your job.

Step 2: Setting Up Your Accounts Receivable

1. Create an invoice template

You want your invoice to be clear so that clients will pay as quickly as possible. Include the following information on your invoice:

- your business contact information

- your business logo (if applicable)

- clear payment terms, such as “payment is due in 30 days of invoice date”

- detail about the specifics of your service

- hours worked

- the name a check should be made out to (particularly important if you operate under a fictitious business name)

2. Save proof of payment and other documents

Just as you document your expenses, also document your accounts receivable. Hold onto the following, and create electronic copies if possible:

- invoices

- cancelled checks

- other proof of payment

3. Create a spreadsheet or ledger

You need something to enter your accounts receivable information onto. Choose a spreadsheet or a ledger book. Also, consider using the software. You can use the same software for accounts receivable that you use for accounts payable.

If you are receiving 5-10 invoices a week, you should consider automating the system.

4. Insert columns for accounts receivable information

Set up columns for the following information on your spreadsheet or ledger:

- customer name

- invoice date

- invoice number

- amount owed

- due date

- amount past due

- date payment was received

5. Post information to your ledgers regularly

Post information to your ledgers regularly. Get in the habit of staying on top of the amounts your customers owe you. You should post accounts receivable regularly, which will depend on the size of your business. The key is to get in a consistent habit so that you don’t forget.

If you’re receiving multiple invoices a day, then posting daily is a good idea.

However, if you have only a few big invoices a month, then you might want to post monthly or weekly.

Nevertheless, if you’re posting accounts payable daily, you should get in the habit of reviewing accounts receivable at the same time.

6. Follow up on late payments

A bookkeeper also needs to track down customers who haven’t paid in a timely fashion. You’ll need to send appropriate letters telling the client their bill is due.

If you find clients aren’t paying the business, you might want to talk with the owner about giving customers more options for making payment. For example, the business could accept credit cards.

Step 3: Documenting Petty Cash

1. Establish the starting balance

You can quickly lose track of where your petty cash has gone if you don’t keep accurate records. Accordingly, start with an initial balance. Make it small enough that your employees won’t feel tempted to steal from it but large enough that it can cover reasonable expenses.

Most small businesses can get by with $50-200 in petty cash.

2. Require receipts

Keep careful records of what petty cash is spent on. Require your employees to provide receipts of all purchases made using petty cash. Have a folder where you store receipts, and get in the habit of organizing receipts on a weekly basis.

3. Create a log

You should also keep a log along with your receipts. You need the log because not every purchase will have a receipt. On the log, record the amount taken from petty cash and what is was spent on. Enter the information immediately.

For example, if you took $20 out to buy new pens for the office, you should enter the information as soon as you remove the money from the petty cash box. If you have money left over, then record that you are returning money to the petty cash box.

4. Replenish by writing a check to yourself

This is a good way to document cash transfers. You can keep a copy of the cancelled check that shows which account you transferred money from. Don’t just take cash from your own wallet and dump it in the petty cash box.

5. Enter petty cash information accurately on your balance sheet

Consider petty cash to be an asset on your financial statements. Don’t neglect to accurately record it. Although the amounts may seem small, they can add up quickly for a small business.

Step 4: Reconciling Your Accounts

1. Keep ledgers for all financial accounts

You may have several business bank accounts. For example, small businesses usually have a checking account to pay bills and a savings account to save up money to pay self-employment tax. You should also create a ledger or spreadsheet for each of your major accounts.

Keeping this ledger will allow you to monitor the current state of your business. You won’t have to wait for the monthly bank statement to see if your business is insolvent or thriving.

2. Reconcile your books

You need to make sure that your monthly recording of expenses is the same that shows up on your bank records. This means analyzing your bank statement and your accounts to make sure the same transactions appear on each.

Reconciliation is a good way to catch mistakes—yours or the bank’s. If the bank makes a mistake, you can contact them. Share whatever documentation you have (receipts, cancelled checks).

You can also catch fraudulent activity with reconciliation. For example, an employee might have withdrawn money from the checking account without telling you.

Perform reconciliation monthly. If you wait too long, it will be harder to reconcile. Also, you won’t catch fraudulent transactions in a timely manner.

3. Meet with the accountant

- You may need to meet with the company’s accountant once a month to go over the books.

- The accountant can identify any recordings that are unclear or inaccurate, and you can talk about them.

The technology is growing, to make it easier to manage bookkeeping, you can use the bookkeeping apps. Below, we list the best bookkeeping apps for small businesses. Stay calm, and read carefully the next sections, because it will help a lot for your company development.

The 8 Best Bookkeeping Apps for Small Business Owners

In the world of small business accounting, bookkeeping apps can change how you do business. Bookkeeping apps can make you or your bookkeeper a lot more efficient by organizing and presenting your financial information in a way that’s accessible and easy to understand. This also makes it easier to plan for your business’s future and understand the impact of different financial decisions. There are several different bookkeeping apps designed for small business.

Here, we’ll cover the eight best bookkeeping apps for small business owners. These apps have the potential to save you lots of time and can elevate your business to the next level.

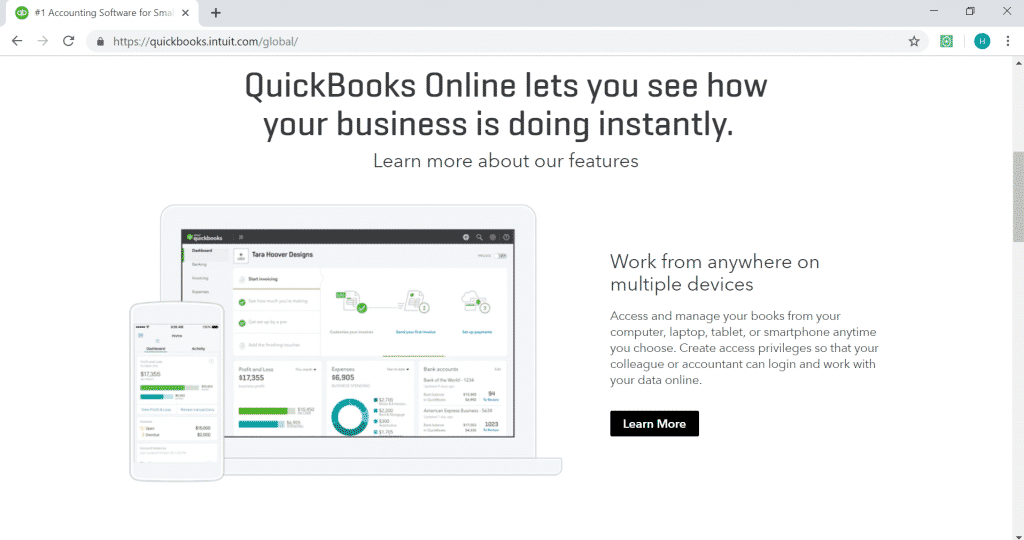

1. QuickBooks Online: Best for Reporting

Out of all cloud-based bookkeeping apps, QuickBooks Online is one of the best overall. You can do all of the basics, such as tracking revenue and expenses, reconciling your accounts, and preparing financial statements. It takes the pain out of manual record keeping because you can simply connect QuickBooks to your bank accounts, credit cards, and other financial accounts.

Compared to other bookkeeping apps. QuickBooks Online also has the best reporting functionality, with over 50 pre-built reports and the ability to create custom reports. You can also schedule reports to run on a periodic basis and be emailed to other individuals on your team. Reports are important, because it is the ultimate output of your books. Reports are how you get the information you need, in order to determine how well your company is doing.

QuickBooks Online also has a great mobile app and a powerful ecosystem at apps.com that lets you complete a solution for just about any industry and any business model.

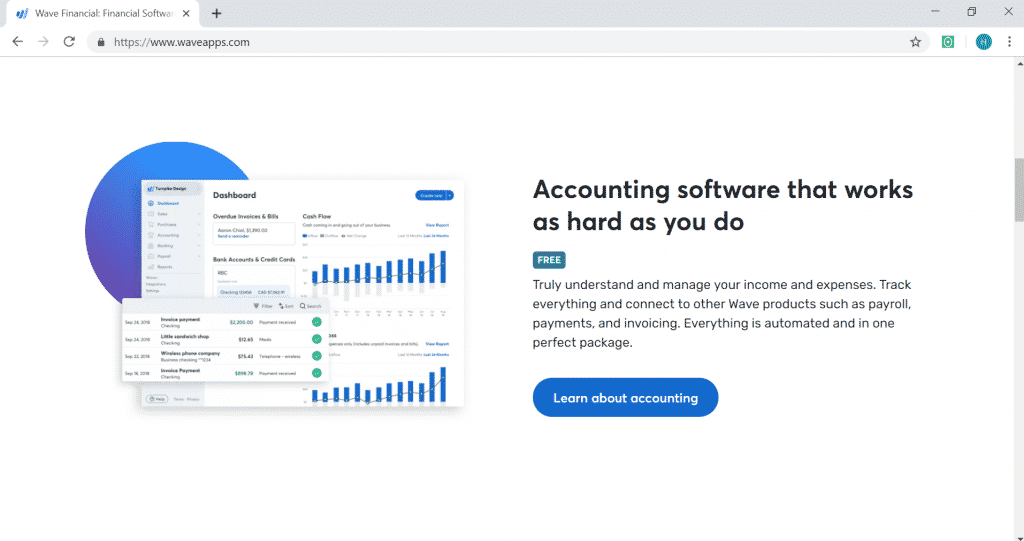

2. Wave: Best Free Bookkeeping App

Wave is a powerful bookkeeping app that also happens to be free at at the entry-level pricing tier. The free pricing plan actually comes packed with quite a few time-saving bookkeeping features. You can sync up an unlimited number of bank accounts and credit cards, and track income and expenses from various streams.

On the invoicing end, you can set up and send custom invoices with a choice of professional invoice templates. Capturing receipts is as easy as taking a picture with your mobile phone, and this feature works even when you’re offline. To accept online payments or add on payroll functions, there are extra fees.

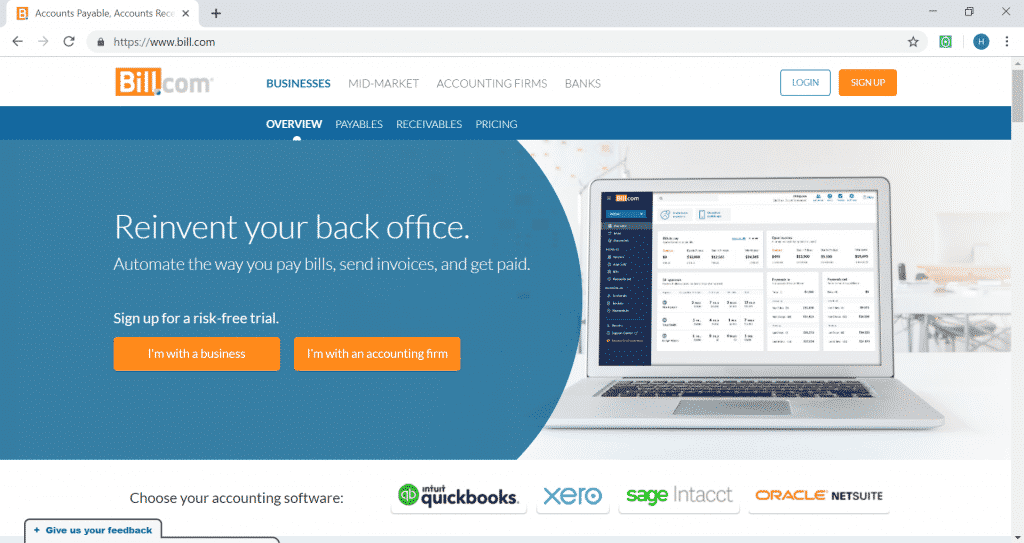

3. Bill.com: Best for Automating Accounts Payable and Accounts Receivable

Bill.com is a bookkeeping app that will save you a ton of time and allow you to almost completely automate your accounts payable process. Accounts payable is one of many tasks that a bookkeeper does. Bill.com works with your existing accounting software, whether that is QuickBooks, Xero, Sage, or Oracle.

With Bill.com, every invoice that a vendor sends you, and eventually the payment that you make, syncs to your accounting software, so you only enter the data once. Vendors can send you a digital invoice to a secure ‘@bill.com’ email address, or you can drag and drop invoices into your Bill.com dashboard. Since Bill.com updates your accounting software for each transaction, transactions reconcile faster, and you have a better real-time view into your business’s expenses.

You can also use Bill.com to manage your accounts receivable. When you have it handling both sides, you also wind up with a powerful cash flow management tool. Bill.com ultimately lets you spend less time entering and paying bills, which is a big part of bookkeeping.

4. QuickBooks Self-Employed

QuickBooks Self-Employed is a basic bookkeeping app that supports one user (plus an optional login for an accountant or bookkeeper). This QuickBooks app gives you the ability to send and track invoices, track mileage, calculate your Schedule C deductions, and see quarterly estimated taxes. It also makes it easy to separate business from personal expenses, which can catch contractors and freelancers off guard and make it much more difficult to file business taxes.

Although you can access QuickBooks Self-Employed on a desktop or laptop, their mobile app lets you do a lot as well. With one swipe, you can easily sort business from personal spending, import expenses from your bank account, and track expenses. You can even set up custom categories for expenses so you know what your business is spending the most money on.

5. Bench: Best for Full-Service Bookkeeping

Bench Accounting is a full-fledged bookkeeping service and app. Bench Accounting is a little different from the other apps on the list because a team of professional bookkeepers will do your bookkeeping for you. To get started, you link your bank accounts, credit cards, and financial accounts to Bench. Every month, your bookkeeping team, made up of one senior bookkeeper and two junior bookkeepers, reconcile your accounts, balance your books, and prepare financial statements.

At the end of the year, Bench will even provide some tax help. They offer a year-end financial package that makes it easy to file small business taxes. They also will talk with your accountant or tax preparer when it’s time to file, to work out any discrepancies.

Along with the personalized services of Bench comes a financial app that lets you track your income and expenses and review your financial statements on the go. It’s also easy to message your bookkeeping team from the app, and they will respond within one business day. Bench will save you a ton of time because they completely take bookkeeping off your plate.

6. Expensify: Best for Handling Expense Reports

The Expensify app makes it a snap—literally with your mobile device’s camera—to capture receipts. Then you can throw the physical receipts away and forget about them. Expensify’s SmartScan will figure out the payee, amount, and other critical info from the receipt. Then you can submit the receipts to be synced to QuickBooks Online, and, if necessary, reimbursed.

Since travel comes along naturally with expense reports, it makes sense that Expensify has an amazing travel concierge and trip planner as well. Just forward your itinerary to Expensify and it will track your trip for you. You’ll even get updates about your flights where applicable, and the concierge will tell you if you’re over-budget on travel.

Expensify has another use not many people think of. It has to do with the business expenses you charge on a personal credit card. Many small businesses co-mingle funds this way, which can be harmful from a financial and legal standpoint. With Expensify you can avoid that by linking up your personal card’s feed but submit only the business-related expenses to be synced to QuickBooks Online.

7. Finagraph: Best for Financial Planning

Finagraph gives you powerful financial information about your business that you can use to make predictions. This app essentially takes your QuickBooks Online data and explains it.

Finagraph is a powerful analytical tool that makes it easy to analyze the financial health of your company and then form a plan of action for how to improve it. Finagraph keeps a history of your “finagraphs” so that you can get comparative info and make sure you’re always improving.

The visual interface of Finagraph makes it a powerful tool for small business owners to use together with their accountant or CPA. You can download almost any component in PDF or an image format. Some modules are interactive, giving you a “Large View”—for example, a close-up look at working capital or accounts receivable.

8. Hubdoc: Best for Document Storage

Hubdoc is a central way to organize all of a small business’s receipts and documents. You can automatically sync up your financial accounts with Hubdoc, forward invoices from your email, or upload paperwork. Once Hubdoc receives your docs, it will archive them and convert the data into digital-ready files. You can then configure any bills from any account to push to your favorite cloud accounting software, such as QuickBooks Online.

These eight bookkeeping apps for small businesses are designed to save you time and help you get a better handle on your finances. They’re all easy to use, and have the powerful features that small business owners are looking for. With these bookkeeping apps, there’s no longer a need to manually track transactions, type information from receipts, or input income and expenses. Your newly organized financial information will help you make better business decisions, while giving you back more time to run your company.

What to Look for in Small Business Bookkeeping Apps

There are several unavoidable bookkeeping tasks that businesses have to do on a regular basis. The bookkeeping apps listed above make it easier and faster to complete these tasks.

Here’s what to look for when shopping for a bookkeeping app:

1. Core Features

Most small businesses use bookkeeping apps for a combination of the following tasks: invoicing, reconciliation, tracking income and expenses, financial statement preparation, and forecasting. Optionally, you might want to add on forecasting or payroll processing.

2.Cost

You shouldn’t have to spend an arm and a leg for a good bookkeeping. Even QuickBooks Online, the gold standard in business bookkeeping, costs just $20 per month and offers a 30-day free trial. Wave is a free option for businesses on a tight budget.

3. User

Friendliness – The whole point of using bookkeeping apps is to free up your time and give you better insight into your business’s finances. There might be an initial learning curve, but it shouldn’t take more than a few weeks to get the hang of your bookkeeping software.

4. Number of Users

Think about whether you’ll be using this bookkeeping app just for yourself or whether you’ll need to share the info with a tax preparer, accountant, or business partner. If you need to share the information, make sure the app is set up for multiple logins and secure sharing of financial information.

5. Automation

A good bookkeeping app frees up your time by automating tasks. For example, instead of manually uploading information from a receipt, the app should be able to “read” and automatically fill in certain information such as the amount and date of the purchase.

As long as you keep these five tenets in mind, you should be able to find a bookkeeping app that’s perfect for your small business’s needs.

Conclusion

If you’re going to leave this guide remembering one thing and one thing only, let it be this advice—take your small business bookkeeping seriously. Whether you’re filing taxes, making a budget, adjusting payroll, or pretty much performing any financial operation for your business, you’re going to need an accurate record of your business’s finances to do it well.

All in all, anything you can manage to do to improve and perfect your small business bookkeeping systems will ultimately improve your business’s performance as a whole.

You might also like: 32 Feasible Small Business Ideas for Women