The Growth Trajectory of PetSmart – a Disruptive Leader within Pet Retail Sphere

Long gone were the days when treating pets like human children was widely seen as socially unacceptable. As cultural shifts ensued, so did perceptions of pet “parents” – beyond any doubt, pets have now been viewed as members of the family, and owners are willing to pay a premium to bring in the best for them. Such willingness to pay top dollar for high-quality pet products bodes particularly well for retailers and brands within the sphere. And PetSmart is amongst the largest beneficiaries.

Founded by Jim Dougherty and Janice Dougherty in 1986 and headquartered in Phoenix, Arizona, PetSmart has risen the crest of a wave and become North America’s “largest specialty pet retailer of services and solutions for the lifetime needs of pets.” From a humble retail store for pet food—an unusual enterprise at the time, when pet food was mostly sold at supermarkets, the company now operates astoundingly around 1,660 stores in the United States, Canada and Puerto Rico, as well as more than 200 in-store PetSmart PetsHotel® dog and cat boarding facilities. Let’s read on to go explore the fascinating growth trajectory of this Phoenix-based pet behemoth!

PetSmart: The Growth Story Behind North America’s Largest Specialty Pet Retailer

Success at The Very First Days

At the very first start, let’s reminisce about the early 1980s when pet retail purchases were in the $5 billion range, in large part from grocery store pet food sales.

Should you have been playing around the pet retail landscape for a while, or take a look over its history, you must hear a lot about Jim Dougherty, who watched the disruption of such landscape happen from the inside. His unique vision saw a need to expand the pet food segment, build on that foundation and bring customers back to buy consumables more often.

An opportunity came in 1980, when the owner of a feed manufacturer approached Dougherty, convincing the Doughertys to move to Las Vegas and establish a retail store for pet food. In fact, the opportunity did not come without major obstacles. The building was on a dead-end street behind a lumber yard with no storefront. Undeterred by these shortcomings, Dougherty managed to transform the empty warehouse and opened the store that year. Not exactly retail gold as far as real estate went, but it nevertheless became a profitable enterprise.

Such an instant success resulted in the expansion of the enterprise to Las Vegas and then in Phoenix, where Jim Dougherty and his wife Janice moved and ultimately decided to launch their own business. The year of 1986 marked the official launch of Petfood Supermarket – and the following year, two more stores came into operation.

At that time, Dougherty realized the opportunities in Las Vegas were comparable to those in Phoenix: market reports indicated there was a huge dog population, and grocery stores had the market share of pet food sales. Having determined that this was another opportunity he could not pass up, he made tremendous efforts to take the pet retail warehouse concept to a new level.

Entrepreneurial Foresight & Disruptive Ideas of Jim Dougherty

To fund their own venture, the Doughertys had borrowed $1 million from a venture capital investor, the shirt manufacturer, Phillips-Van Heusen Corporation. Armed with the financial backing of a major shirt manufacturer, Dougherty assembled a management team that consisted of a group of dedicated individuals who had a passion and resolve that would propel the business to success.

Incorporating in 1986 as Pacific Coast Distributing, the short-term plan was to open two 20,000-plus-square-foot stores in the Phoenix area whilst the long-range strategy was to build out a pet warehouse chain and expand the business across the nation. The plan was to lease vacant grocery stores and convert them into a warehouse setting. When it comes to the business mission, it was to form a huge yet solid customer base by providing them with grocery store brands and specialty brand foods. Not only food, but the pet store chain would also provide customers with an endless supply of pet-related products, which included collars, leads, beds, crates, bulk rawhide bones and more, under one roof.

Opened in 1987, Petfood Warehouse welcomed both pet owners and their pets, which was a first for the pet industry. This was truly a breakthrough since, prior to this, only service dogs were allowed inside retail outlets. The goal was to create a bond with the pet owner, their pet and PetSmart – such bonds would bring the customer and their pet back to the company for purchases of food, products and services.

A second unique feature was added: pet adoptions. Particularly, Jim Dougherty began working with local animal welfare groups to hold fundraising and pet adoption events at its stores. Local pet shelters brought homeless pets to the stores on a regular basis and would also hold adopt-a-thons.

Besides, there was a time when most pet product manufacturers would never sell direct to stores and the American Pet Product Manufacturers Association wouldn’t allow retailers to attend their annual trade show unless you had five stores or more. Dougherty and his business changed all of that and the revolution began. After all, such disruptive ideas and a commitment to customer satisfaction enabled Petfood Warehouse to carve out a unique market share in the pet retail industry at that time and today.

“My career in the pet retail business has been a phenomenal experience… The pet industry and its evolution has been a fascinating segment of the business world, and I have been blessed to have been a part of it.”

– Jim Dougherty, co-founder of PetSmart

From “PetFood Warehouse” to Finally “PetSmart”

As developers were concerned with the word “warehouse” in the store name, a name change was considered a “must” and a contest was then conducted, which allowed associates and customers to submit and choose the new name. Dozens of names were submitted and the winner of the contest went to “PetSmart”!

The business name was officially changed to PetSmart in 1989 so as to better reflect the more diverse services. At that time, PetSmart also began to offer its own adoption program rather than simply playing host to outside groups.

The business got a new name and … a new chief!

After the departure of the Doughertys with nervous investors choosing him for his experience, Samuel J. Parker – a 19-year veteran of the Jewel supermarket chain – was brought in as chairman. Once Parker was brought on board, the retailer shifted away from the warehouse concept, and sweeping changes were made to the retail operations. Those changes included the replacement of cement floors with tile floors, wider aisles and brighter lighting; in addition, pet accessories and supplies were added with the idea of beating rivals with a far greater selection of products at substantially reduced prices.

Two years after opening the warehouse-style pet retail store and with a new name, PetSmart was undoubtedly on a path to become the industry leader. In 1992, PetSmart opened its first in-store adoption center and veterinarian clinic – those service additions have continued in the years since. In addition to marketing pet food and accessories, PetSmart’s store chain offers boarding, medical services, grooming, training and adoption. By 1992, annual sales jumped to whoppingly $106.6 million and for the first time, the company registered a profit, generating $400,000 in net income after recording a series of financial losses. By the time of 1994, PetSmart boasted 100 stores across the nation.

One year before, in 1993, PetSmart went public on the Nasdaq under PETM at $18 per share in an initial public offering that witnessed a 46 percent surge in the share price on day one. Along the course of the mid-1990s, the business kept growing and began acquiring rivals, including Pet City Holdings in 1996, and Petstuff in 1995. Given the spectacular failure of Pets.com in the dot-com era, the PetSmart.com folks acquired that name as well as Hamster.com. in 2000 for undisclosed terms.

The Acquisition of PetSmart: The Biggest Private Equity Deal of The Year

In 2014, PetSmart operated more than 1,300 pet stores in the United States, Canada and Puerto Rico. Given its solid growth potential as well as relatively strong cash flow and low debt, PetSmart became a good target for private equity firms.

Eventually, in December 2014, PetSmart closed a deal to sell itself to a group led by the investment firm BC Partners for a staggeringly $8.7 billion, months after the retailer came under pressure from two hedge funds. This emerged as the biggest private equity deal of 2014 — in a year of huge takeovers of cable providers and drug manufacturers — which was considered a bet on the lucrativeness of dog food and catnip.

“The question is, ‘Why haven’t there been more people interested in PetSmart?’” stated Raymond Svider, a managing partner of BC Partners. “The category of pet products has been growing in the U.S. and abroad consistently for a number of years.”

Before that, in August, the retailer disclosed that it was exploring a sale after Jana Partners, the big activist investor, emerged as a major shareholder with its stake at 9.75 percent. The pet supply company had already been weighing its strategic options as its sales had begun to dwindle. In the meanwhile, Jana and another firm, Longview Asset Management, had begun agitating for a sale of the company.

The months-long auction of PetSmart finally captured the interest of some of the biggest private equity firms, including Apollo Global Management, Kohlberg Kravis Roberts and Clayton Dubilier & Rice. Ultimately, BC Partners, a European-American firm with about $15 billion under management, and some of its own investors emerged as the winner.

“We are pleased to have reached this agreement with BC Partners, which maximizes value for all of our shareholders and best positions PetSmart to continue to meet the needs of pet parents,” Gregory P. Josefowicz, PetSmart’s chairman, presented in a statement. “This transaction represents the successful conclusion of our extensive review of strategic alternatives.”

Its Growth Trajectory Onwards

Whereas there exist dozens of pet supply chains within the pet landscape, one rises above the flock. Listed among the top-selling retailers in the United States in 2019, PetSmart has its chain expand to 1,660 locations as of February 2020, more than any other North American pet specialty chain.

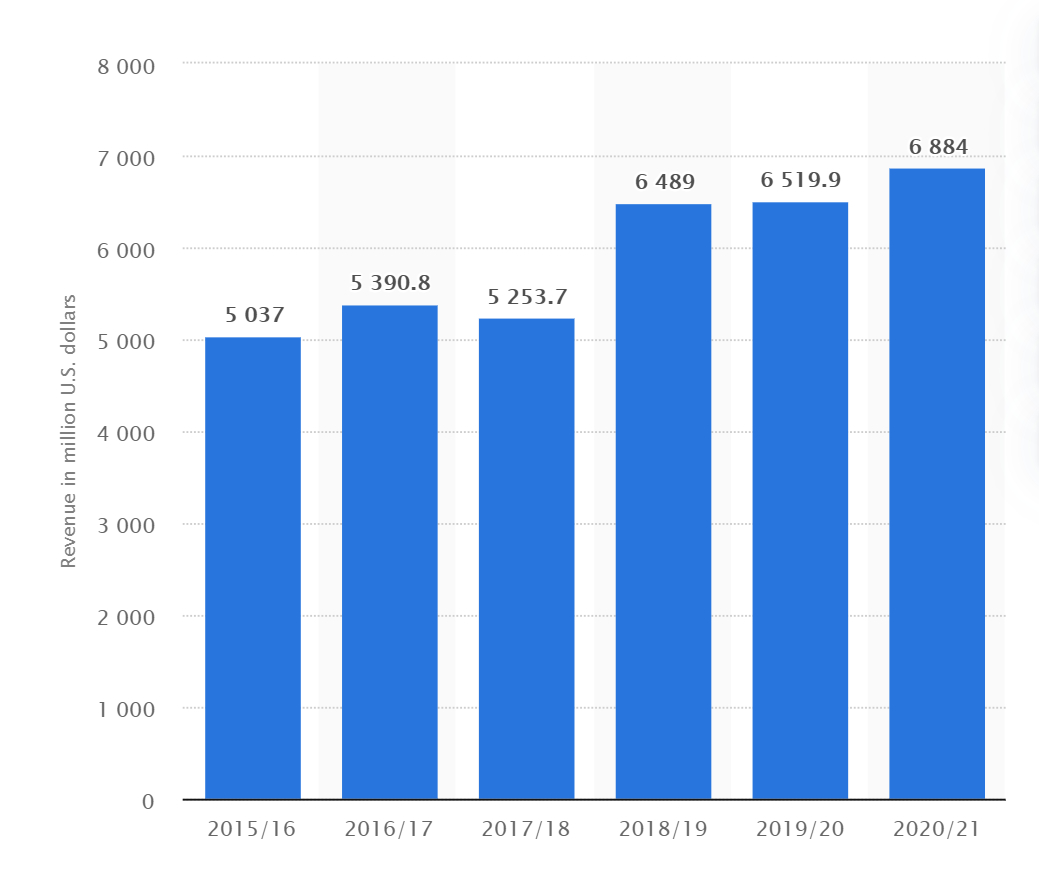

When it comes to its revenue streams, PetSmart brings revenue in from brick-and-mortar stores across the U.S. as well as in Canada and Puerto Rico. Whereas there are enormous varieties of toys, accessories, supplies, services, and clothing for pets, the pet food segment generates the largest share of sales at PetSmart. Ranked as one of the fastest-growing e-retailers in the United States, it is obvious from the chart that PetSmart did nearly double its sales between 2016 and 2017.

What should also be noted is that in addition to physical storefronts, the company also offers its customers the option to shop online and have products delivered directly to their doorsteps. Still, the majority of customers prefer the idea of purchasing all of their pet food and supplies in-store rather than online. Nevertheless, given that the online pet care market has shown enormous growth, with the e-commerce pet care sales increasing by 3.4 billion U.S. dollars in 2018 alone, it is likely that more consumers will turn to online channels for pet purchases in the future.

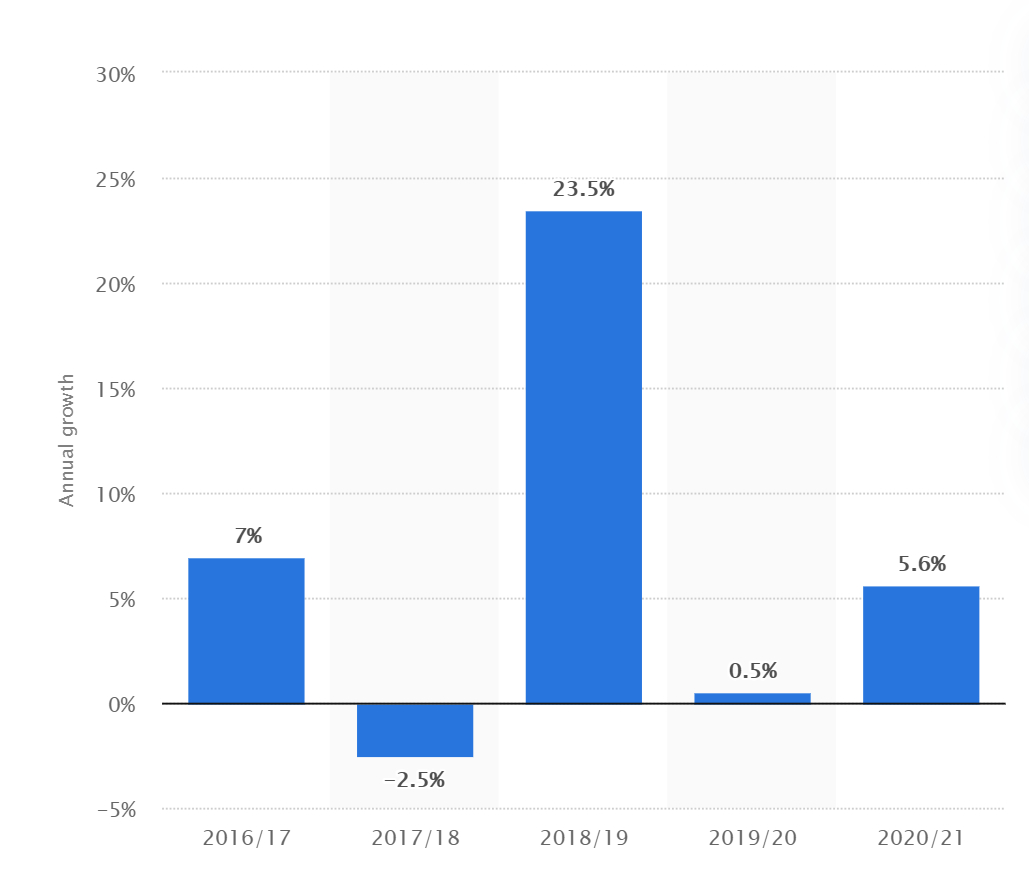

As regards PetSmart’s annual growth in revenue, the retailer took up a 33.7 percent share of pet store market revenue in 2019, a larger proportion than any other pet supply shop in the United States. Whereas the annual growth suffered downward trends in the following, partly due to the gloomy economic situation, PetSmart is expected to maintain a solid growth pace as a disruptive leader within the sphere.

The Bottom Lines

In the 1980s, as the pet retail scene was in its infancy and innovation was limitless, PetSmart did pioneer a plethora of concepts in an effort to deliver customers with a one-stop shopping experience. In the 2020s, as pet industry expenditure has already experienced meteoric growth, the business does handsomely hold its position as the largest specialty pet retailer across the nation, despite all the hurdles. Let’s take a second look over these above words to embrace even more the growth story of this Phoenix-based pet juggernaut!