What to Learn about Authorize Net’s Success and the Current Payment Industry?

Authorize is also known as a subsidiary of Visa, which means the service is backed by the tried and tested mechanisms used by Visa in the processing of payments. The company services are supported in the United States, the United Kingdom, Europe, Canada, and Australia. It takes care of the transactions process, even though in an online setting without software installation, basically like the card swiping machine.

However, as the payment industry is seeing more than just booming effect, there are many hardcore players to count, especially in the online payment or any other payment gateway. But first, let us make clear of this concept!

What Is Payment Gateway and Its Important role on Your Business Image?

Even with the excellent interface and functionalities in your website or app, but if the payment experience is not good then? Eventually, customers stop trusting us and the sales and customer engagement will drop. The payment gateway plays an important role in the customer buying experience, the good payment gateway should be smooth, fast, secure and trustworthy.

Today we’re looking at it from the other side – from a business owner’s perspective, aka the merchant.

Every business needs a payment gateway in order to handle payments from their website. Not all payment gateways are created equally, however. There are a few important things to weigh up when choosing a payment gateway, including:

Compatibility: Does the payment gateway integrate with your chosen e-commerce platform? Accessibility: Is the payment gateway available in your country? Usability: What is the checkout process like for your customers? Cost: How much does the service cost? Cash out duration: How quickly can you access your funds?

Making A Choice: The Right Payment Gateway

In addition to their basic function of transmitting and receiving credit card transaction data via the internet, most payment gateways also come with several useful extra features. The ones that you should look out for while selecting the right payment can be:

Multi- currency acceptance, PCI Compliance, Mobile Optimization and SDK, Flexible Integrations, Faster Checkout, Fastest Setup Time, Support Different Kinds of Payments, Safe and Secure and more.

Payment gateway is not so new of a business, otherwise it is actually thriving and expected to be the only method in the future that customers would consider for transactions, especially as we are seeing the rise of ecommerce and the shift toward a tokenized economy.

Let us take a quick look at many key players in such field, namely? Stripe, Paypal, Amazon Pay, Square, CashU, SecurePay, BlueSnap and especially AuthorizeNet – an old oak I believed would fascinate you as it has been around for a while, but decades later still manage to compete this game.

The Uniqueness and Overlook at How Authorize Makes Money?

Established in 1996, Authorize is one of the oldest payment gateway providers around. Today it serves over 430,000 merchants and manages over one billion transactions every year. Due to its longevity, Authorize has partnerships with most merchant account providers, allowing its users to accept payments from major credit cards, debit cards, and digital payments, as well as e-checks and foreign payments from most countries. So, how to explain this success?

Besides being a subsidiary of Visa, which has granted the company a strong credibility, the firm has managed to grow this big mainly for its flexibility and agility to not only provide a solidly secure service but also varied in products.

In general, Authorize is more seen amongst small- to medium-sized businesses, however, it offers three distinct types of plans to ultimate its approach to businesses of all sizes. On top of which, the company will charge you a $49 setup fee and a $25 monthly gateway fee

First, with the All-in-One Option the company aim at small businesses that do not have their own merchant accounts with a bank provider. It takes $25 for monthly cost and charges 2.9 percent plus $0.30 per transaction.

Second, toward businesses that already have a merchant account and just need the technology to process and accept payments, Authorize give them The Payment Gateway Only. This package will cost the same $25 each month, plus $0.10 per transaction, however, along with daily batch fee of $0.10.

Thirdly, for business at scale the company comes up with The Enterprise Solutions which are uniquely designed for businesses that ship more than $500,000 per year. However, in such plan pricing is tailored to each company, so you will have to reach out for more information.

And of course, companies such size accepts all major credit cards, signature debit cards, e-checks, and digital payment solutions, yet a cool point here is that Authorize allow customers to integrate with PayPal.

It’s also compliant with PCI DSS, plus offers a number of customizable security settings to fight fraud, like IP Filters and Transaction Filters.

Hosted Vs Non-Hosted Players and Authorize’s Vision in Payment Market?

There are two aspects of this story:

In term of a merchant, obviously you want to be equipped with a user experience where customers do not have to leave the merchant shopping page – that is when Non-hosted payment gateway comes into handy. However, as convenient as it is, you need an SSL certificate and to comply with certain legal or technical PCI requirements to take payments onsite. For instance, Stripe is one of a payment processor that provide non-hosted environment.

In term of a shopper, if you have ever had Paypal as a payment tool, then you would have noticed that after Paypal is selected as the payment processor at the shopping checkout page, you will be transferred to the Paypal payment page – away from the merchant page which is called Hosted in payment gateway’s user experience.

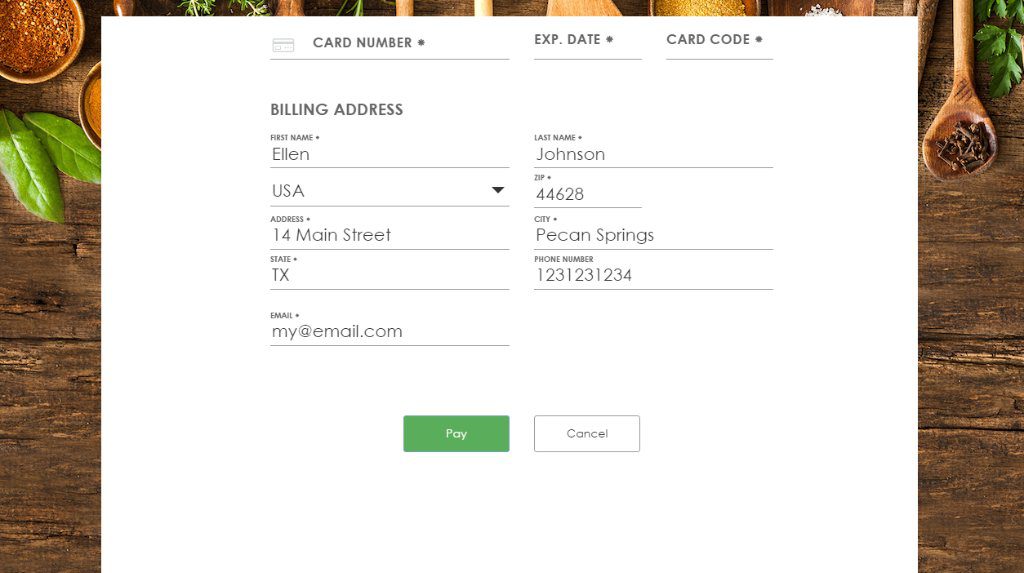

While this is secured as all the PCI compliance is done by the Payment processor/gateway, yet it does not give a great user experience. Therefore, at Authorize whose customers are mainly small business owners, they develop a simple checkout where merchants can redirect customers to the Accept Hosted payment form which is embedded directly in merchants’ own page. The best of both world – secure and at the same time consumer friendly.

In general, hosted payment gateways are highly secure, simpler, and customizable whereas non-hosted payment gateways are more versatile and provides better customer experience. Based on requirement business owners will have their own way out of it.

Authorize’s success explained: Elements to cause the rise of Authorize

We have put together a brief overview of Authorize features to have a better look on how the company has differentiated it business, among others.

#1 Acceptance of All Major Credit Cards and Payment Services

Through Authorize’s method, merchants would be able to enable shoppers the ability to choose any of the most popular credit cards and payment services – PayPal, American Express, Visa, Mastercard or any others. Additionally, the company also grant access to e-checks and plenty mobile payment options which is believed to be a foremost feature any payment processor should have in advance.

In term of mobile in-app transactions for mobile e-commerce apps, it is not so much different with others, Authorize enable credit card payment directly within the apps. In which case, the credit card data is not forwarded to the mobile app server, therefore, merchants as well as shoppers will be at a higher level of protection. Additionally, within app transactions, Authorize also aid Apple Pay and Android Pay services, accordingly, support multiple options for shoppers and at the same time allowing merchants to reach maximum audience.

And another effort to reach customer that you can see in Authorize is how the company integrate PayPal Express checkout feature into shoppers’ cart. Therefore, with buyers with Paypal accounts, the checkout will be as simple as a click away from confirming their purchase. This way, the company is on its way attracting the multi-million PayPal user audience.

#2 Put Best Effort in Fraud Prevention

Interesting fact! Authorize is quite well-known for its level of security as the company brings in a highly customizable fraud prevention suite for its business. To equip merchants with a fraud prevention system corresponding to business need, the company has developed about 13 fraud filters – it is trying to reach as much business model as possible.

Using the filters, you can configure alerts or transaction blocking based on IP address, transaction amount, number of transactions within one day or one hour. Filters can be set to verify whether the billing address matches the shipping address and stop transactions in case of a mismatch.

Besides, Authorize also allows verification of the credit card data and rejection of transactions with credit cards that do not pass the verification. And of course, fraud prevention mechanism comes with the main package, no additional charge for this.

#3 Leverage on Customer Information Manager

Authorize allows processing so-called “recurring payments” using the payment data stored during previous transactions. With the “card on file” feature, customers do not need to re-enter their credit card details if they wish to use the same card.

Besides the payment information, the service also stores the shipping address that can be used to populate the order form during subsequent purchases. The customer profile can contain more than one form of payment and shipping address allowing the customer to choose the appropriate one. The stored data can be updated by the customer, as necessary.

While it stores lots of sensitive data, such as customers’ names and credit card details, the company has to be more advanced in security mechanisms to protect such data from theft. The credit card details are stored on secure servers.

The Customer Information Manager allows users to tokenize their details to store them on Authorize servers. Such tokenization, as well as other security measures applied by the payment gateway, makes it PCI DSS compliant.

#4 Transaction Reporting

For online merchants, Authorize.NET provides a comprehensive transaction reporting functionality allowing to monitor their payments and analyze various transaction-related data.

For example, by installing the Authorize.NET payment method, you are getting complete transaction lists with their details, lists of unsettled transactions, transactions by a specific customer profile, batch transaction statistics, and so on.

#5 Authorize Accept Developer Suite

Authorize Accept is intended for developers of e-commerce websites and mobile apps and includes a number of tools for building online commerce platforms. Web and mobile online stores built with Authorize Accept work with all popular browsers and allow processing both credit cards and e-checks. Most versions of Authorize. Accept support hosted payment forms.

What is also important is that e-commerce platforms built with Authorize Accept have inherent PCI compliance mechanisms, thus, the merchants do not need to implement additional measures to ensure compliance.

Top Websites That Are Using Authorize

According to Similartech’s data Authorize is running about 15,943 websites along with 13,748 unique domains. Including many top websites:

| Website | Traffic rank | Monthly visits |

| – Eventbrite – Wufoo – Roguefitness – Reason – Freeroms – Deram-singles – Texags | 1,994 2.543 10,509 20,044 12,997 9,352 14,883 | 29.9M 5.3M 4.5M 4M 3.7M 3.7M 3M |

The Bottom Lines

For the art of turning shoppers into buyers partly depends on how efficient merchant’s payment process work, especially within such era of e-commerce where an online website is a must along with brick-and-mortars.

According to a recent McKinsey payment industry report expects revenue the online payments providers can collect as fees will increase from $82 billion in 2018 to $138 billion in 2024. And even though Authorize has lost some of its share on the market for PayPal, the old oak is still holding a firm position with many of its best secure policy.